Dana Dodson died October 31, 2021, with a gross estate of ($16.7) million, debts of ($200,000,) and

Question:

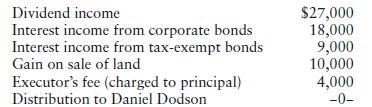

Dana Dodson died October 31, 2021, with a gross estate of \($16.7\) million, debts of \($200,000,\) and a taxable estate of \($16.5\) million. Dana made no taxable gifts. All of her property passed under her will to her son, Daniel Dodson. The estate chose a June 30 year-end. Its receipts, disbursements, and gains for the period ended June 30, 2022, were as follows:

Of the \($27,000\) dividends received in the estate’s first tax year, \($7,000\) were declared October 4, 2021, with a record date of October 25 and a payment date of November 4, 2021. The corporate bonds pay interest each August 31 and February 28. The estate collected \($18,000\) corporate bond interest in February 2022 and August 2022. The taxexempt bonds pay interest each June 30 and December 31. The estate collected \($4,500\) in December 2021 and \($4,500\) in June 2022 from the tax-exempt bonds. Dana, a cash basis taxpayer, sold land in 2020 for a total gain of \($60,000\) and used installment reporting. She collected principal in 2020 and reported gain of \($40,000\) on her 2020 return. The estate collected additional principal in March 2022 and the remaining principal payment in March 2023. The gain attributable to the March 2022 and March 2023 principal collections is \($10,000\) per tax year. Ignore interest on the sale.

Calculate the following:

a. Deductible executor’s fee.

b. Total IRD and the IRD reported on the return for the period ended June 30, 2022.

c. Total Sec. 691(c) deduction if none of the debts are DRD.

d. Section 691(c) deduction deductible on the estate’s income tax return for the period ended June 30, 2022.

e. Taxable income of the estate for its tax year ended June 30, 2022.

f. Marginal income tax rate for the estate for its tax year ended June 30, 2022.

Step by Step Answer:

Pearsons Federal Taxation Corporations Partnerships Estates And Trusts 2024

ISBN: 9780138101787

37th Edition

Authors: Luke E. Richardson, Mitchell Franklin