Aaron Woods, a 27-year-old bachelor living in Richmond, Virginia, has been a high-school teacher for 5 years.

Question:

Aaron Woods, a 27-year-old bachelor living in Richmond, Virginia, has been a high-school teacher for 5 years. For the past 4 months, he’s been thinking about buying a Subaru Outback, but feels he can’t afford a brand-new one. Recently, however, his friend Trevor Phillips has offered to sell Aaron his fully loaded Subaru Outback 2.5XT Limited. Trevor wants $22,500 for his Outback, which has been driven only 7,000 miles and is in very good condition. Aaron is eager to buy the vehicle but has only $8,000 in his savings account at Spider Bank. He expects to net $8,000 from the sale of his Chevrolet Camaro, but this will still leave him about $6,500 short. He has two alternatives for obtaining the money. a. Borrow $6,500 from the First National Bank of Richmond at a fixed rate of 8% per annum, simple interest. The loan would be repaid in equal monthly installments over a 3-year (36-month) period. b. Obtain a $6,500 installment loan requiring 36 monthly payments from the Richmond Teacher’s Credit Union at a 6.5% stated rate of interest. The add-on method would be used to calculate the finance charges on this loan.

Critical Thinking Questions

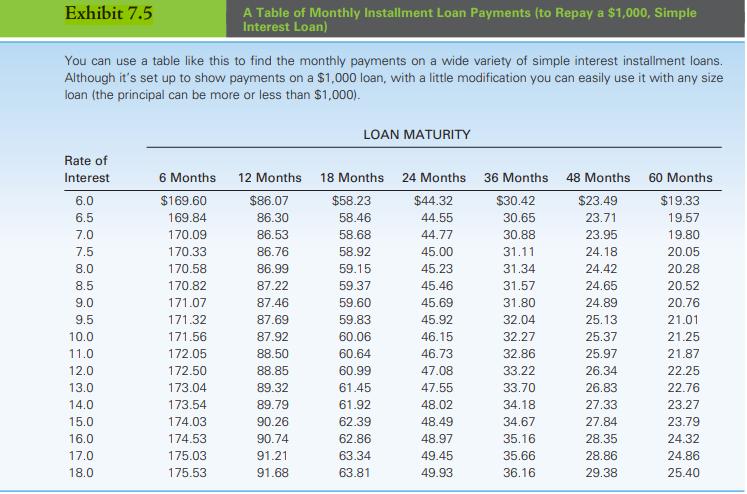

1. Using Exhibit 7.5 or a financial calculator, determine the required monthly payments if the loan is taken out at First National Bank of Richmond.

2. Compute (a) the finance charges and (b) the APR on the loan offered by First National Bank of Richmond.

3. Determine the size of the monthly payment required on the loan from the Richmond Teacher’s Credit Union.

4. Compute (a) the finance charges and (b) the APR on the loan offered by the Richmond Teacher’s Credit Union.

5. Compare the two loans and recommend one of them to Aaron. Explain your recommendation.

Step by Step Answer:

Personal Financial Planning

ISBN: 9781439044476

12th Edition

Authors: Lawrence J. Gitman, Michael D. Joehnk, Randy Billingsley