Martin Moreno is 42 years old, single, and works as a designer for a major architectural firm.

Question:

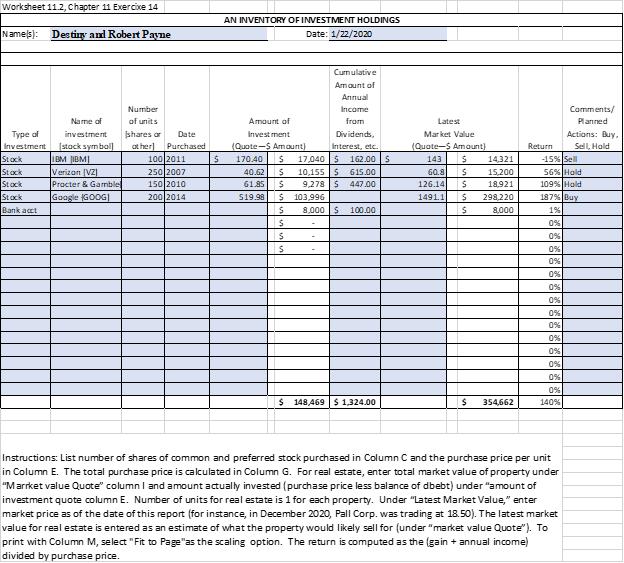

Martin Moreno is 42 years old, single, and works as a designer for a major architectural firm. He is well paid and over time has built up a sizable portfolio of investments. He considers himself an aggressive investor and, because he has no dependents to worry about, likes to invest in high-risk/high-return securities. His records show the following information.

1. In 2006, Martin bought 200 shares of eBay (Nasdaq; symbol EBAY) at $29.77 a share.

2. In 2013, he bought 250 shares of Facebook (Nasdaq; symbol FB) at $26.89 a share.

3. In 2008, Martin bought 200 shares of United Technologies Corp. (NYSE; symbol UTX)) at $74.92 a share.

4. In early 2009, he bought 450 shares of JPMorgan Chase (NYSE; symbol JPM) at $16 a share.

5. Also in 2009, Martin bought 400 shares of Pepsico (NYSE; symbol PEP) at $52.50 a share.

6. He has $12,000 in a 1 percent money market mutual fund.

Every 3 months or so Martin prepares a complete, up-to-date inventory of his investment holdings.

1. Use a form like Worksheet 11.2 to prepare a complete inventory of Martin’s investment holdings.

2. What is your overall assessment of Martin’s investment portfolio? Does it appear that his personal net worth is improving because of his investments?

3. Based on the worksheet you prepared in Question 1, do you see any securities that you think Martin should consider selling? What other investment advice might you give Martin?

Step by Step Answer:

Personal Financial Planning

ISBN: 9780357438480

15th Edition

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk