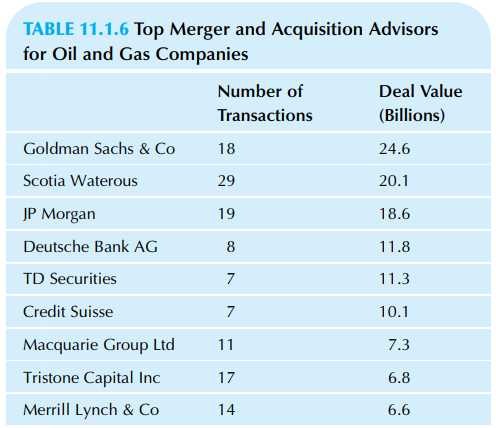

Consider the number of transactions and the total dollar value of merger and acquisition deals in the

Question:

Consider the number of transactions and the total dollar value of merger and acquisition deals in the oil and gas industry, from Table 11.1.6.

a. Find the regression equation for predicting the dollar value from the number of transactions.

b. What is the estimated dollar value attributable to a single additional transaction for these investment bankers, on average?

c. Draw a scatterplot of the data set with the regression line.

d. Find the expected dollar amount for Goldman Sachs and the residual value. Interpret both of these values in business terms.

e. Find the standard error of the slope coefficient. What does this number indicate?

f. Find the 95% confidence interval for the expected marginal value of an additional transaction to these firms. (This is economics language for the slope.)

g. Test at the 5% level to see if there is a significant relationship between the number of transactions and the dollar value.

h. Your investment banking firm is aiming to be in the top group next year, with 25 transactions. Assuming that you will be “just like the big ones,” compute a 95% confidence interval for the dollar amount you will handle.

Step by Step Answer: