In the BeerCo case discussed in section 15.6, the companys pro forma statements that correspondto the current

Question:

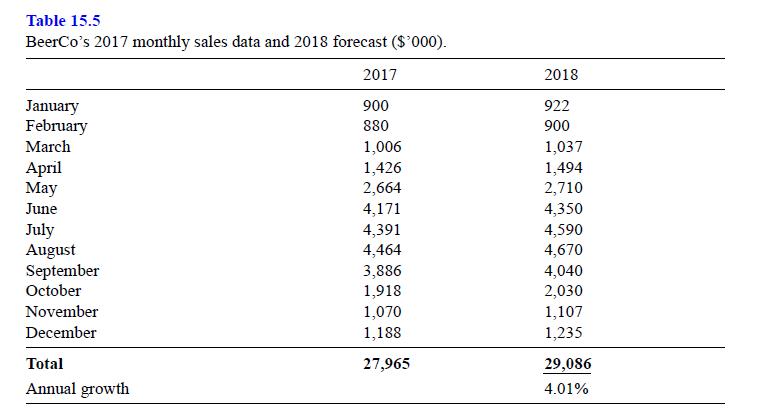

In the BeerCo case discussed in section 15.6, the company’s pro forma statements that correspondto the current chase production strategy are compared to the level strategy ones. Now assume that BeerCo considers the possibility of following a mixed production strategy (i.e., a combination of chase and level). Construct the pro forma statements that correspond to a mixed strategy, where the level monthly production rate is equal to $1.2 million (in terms of cost of goods produced), while any additional production requirements are fulfilled by a chase system. In your calculations, please note that the cost of goods produced—as percentage of sales dollar volume—is estimated differently under the two strategies.

a. What would be the average and maximum short-term debt requirements under the mixed strategy?

b. What is the projected RONA under a mixed strategy? How does it compare with the projected RONA of a pure level or chase strategy?

c. Optional: Which is the optimal production strategy that maximizes RONA? To answer this question, please test different values for the level monthly production rate component of the mixed strategy.

Step by Step Answer:

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice