Returning to problem 5, now assume that the products to be removed are strategicin the sense that

Question:

Returning to problem 5, now assume that the products to be removed are strategic—in the sense that they drive sales from some key customers—and also that their wholesale price is \($70\) (instead of \($50).\) After reviewing its production processes, the company has realized that these three products share some key ingredients, which makes possible the application of postponement. That is, the firm can maintain inventory of a generic intermediate product, which then can be differentiated to each of the H, I, or J products within one week of each inventory replenishment order. The other parameters in problem 5 remain unchanged. If the company is planning to replace this product family in two years, what is the maximum investment cost it would be willing to accept for implementing this capability? Please use the NPV approach to base your answer to this problem.

Problem 5

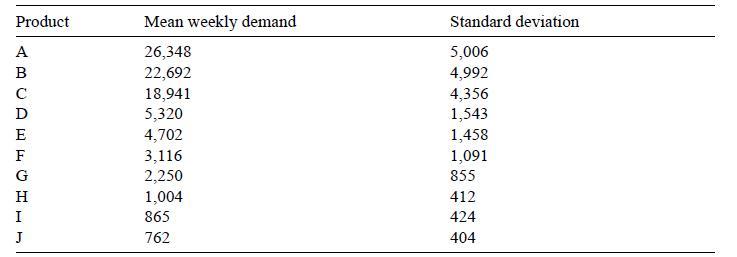

A boutique cosmetics manufacturer is considering reducing the assortment in one of its product families to decrease complexity in its operations. The following table shows the mean and standard deviation of weekly demand for each of the ten different products comprising this product family.

Suppose that the company intends to remove products H, I, and J from its portfolio. To answer the following questions, assume that for all products the unit wholesale price is \($50,\) the standard cost per product unit is \($22\) (assume all variable), and annual inventory holding cost is 20 percent.

Step by Step Answer:

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice