A life insurance company sells a term insurance policy to 21-year-old males that pays $100,000 if the

Question:

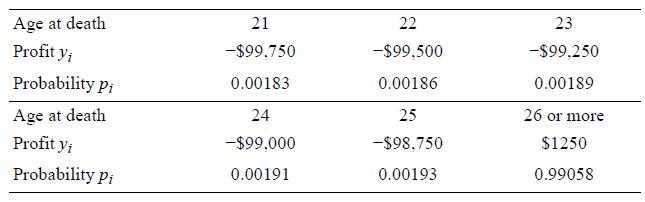

A life insurance company sells a term insurance policy to 21-year-old males that pays $100,000 if the insured dies within the next 5 years. The probability that a randomly chosen male will die each year can be found in mortality tables. The company collects a premium of $250 each year as payment for the insurance. The amount Y that the company earns on a randomly selected policy of this type is $250 per year, less the $100,000 that it must pay if the insured dies. Here is the probability distribution of Y:

a. Explain why the company suffers a loss of $98,750 on such a policy if a client dies at age 25.

b. Calculate the expected value of Y. Explain what this result means for the insurance company.

c. Calculate the standard deviation of Y. Explain what this result means for the insurance company.

Step by Step Answer: