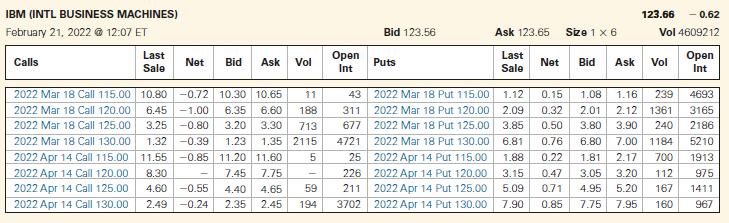

Below is an option quote on IBM from the CBOE Web site showing options expiring in March

Question:

Below is an option quote on IBM from the CBOE Web site showing options expiring in March and April 2022.

a. Which option contract had the most trades on that day?

b. Which option contract is being held the most overall?

c. Suppose you purchase one March 125 Call option. How much will you need to pay your broker for the option (ignoring commissions)?

d. Explain why the last sale price is not always between the bid and ask prices.

e. Suppose you sell one March 125 Put option. How much will you receive for the option (ignoring commissions)?

f. The calls with which strike prices are currently in-the-money? Which puts are in-the-money?

g. What is the difference between the March 115 Call option and the April 115 Call option?

Why is the second option more valuable?

h. On what date does the March 115 Call option expire? In what range must IBM’s stock price be at expiration for this option to be valuable?

Step by Step Answer: