Should the capital budgeting committee accept the internal auditors first and second suggestions, respectively? A. No for

Question:

Should the capital budgeting committee accept the internal auditor’s first and second suggestions, respectively?

A. No for Suggestions 1 and 2.

B. No for Suggestion 1 and Yes for Suggestion 2.

C. Yes for Suggestion 1 and No for Suggestion 2.

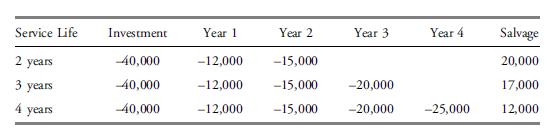

The capital budgeting committee for Laroche Industries is meeting. Laroche is a North American conglomerate that has several divisions. One of these divisions, Laroche Livery, operates a large fleet of vans. Laroche’s management is evaluating whether it is optimal to operate new vans for two, three, or four years before replacing them. The managers have estimated the investment outlay, annual after-tax operating expenses, and after-tax salvage cash flows for each of the service lives. Because revenues and some operating costs are unaffected by the choice of service life, they were ignored in the analysis. Laroche Livery’s opportunity cost of funds is 10 percent. The table below gives the cash flows in thousands of Canadian dollars (C$).

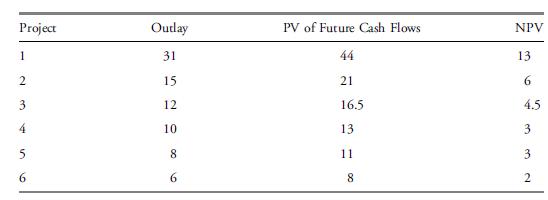

Schoeman Products, another division of Laroche, has evaluated several investment projects and now must choose the subset of them that fits within its C\($40\) million capital budget. The outlays and NPVs for the six projects are given below. Schoeman cannot buy fractional projects, and must buy all or none of a project. The currency amounts are in millions of Canadian dollars.

Schoeman wants to determine which subset of the six projects is optimal.

A final proposal comes from the division Society Services, which has an investment opportunity with a real option to invest further if conditions warrant. The crucial details are as follows:

• The original project:

• An outlay of C\($190\) million at time zero.

• Cash flows of C\($40\) million per year for Years 1–10 if demand is “high.”

• Cash flows of C\($20\) million per year for Years 1–10 if demand is “low.”

• Additional cash flows with the optional expansion project:

• An outlay of C\($190\) million at time one.

• Cash flows of C\($40\) million per year for Years 2–10 if demand is “high.”

• Cash flows of C\($20\) million per year for Years 2–10 if demand is “low.”

• Whether demand is “high” or “low” in Years 1–10 will be revealed during the first year.

The probability of “high” demand is 0.50, and the probably of “low” demand is 0.50.

• The option to make the expansion investment depends on making the initial investment. If the initial investment is not made, the option to expand does not exist.

• The required rate of return is 10 percent.

Society Services wants to evaluate its investment alternatives.

The internal auditor for Laroche Industries has made several suggestions for improving capital budgeting processes at the company. The internal auditor’s suggestions are as follows:

Suggestion 1. “In order to put all capital budgeting proposals on an equal footing, the projects should all use the risk-free rate for the required rate of return.”

Suggestion 2. “Because you cannot exercise both of them, you should not permit a given project to have both an abandonment option and an expansion/

growth option.”

Suggestion 3. “When rationing capital, it is better to choose the portfolio of investments that maximizes the company NPV than the portfolio that maximizes the company IRR.”

Suggestion 4. “Project betas should be used for establishing the required rate of return whenever the project’s beta is different from the company’s beta.”

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan