Suppose HiFly acquires Sky Systems for the stated terms. The gain to Sky Systems shareholders resulting from

Question:

Suppose HiFly acquires Sky Systems for the stated terms. The gain to Sky Systems shareholders resulting from the merger transaction would be closest to:

A. \($25\) million.

B. \($160\) million.

C. \($375\) million.

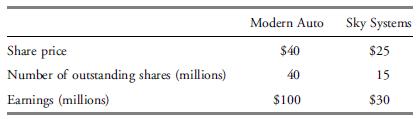

Modern Auto, an automobile parts supplier, has made an offer to acquire Sky Systems, creator of software for the airline industry. The offer is to pay Sky Systems’ shareholders the current market value of their stock in Modern Auto’s stock. The relevant information it used in those calculations is given below:

Although the total earnings of the combined company will not increase and are estimated to be \($130\) million, Charles Wilhelm (treasurer of Modern Auto) argues that there are two attractive reasons to merge. First, Wilhelm says, “The merger of Modern Auto and Sky Systems will result in lower risk for our shareholders because of the diversification effect.”

Second, Wilhelm also says, “If our EPS increases, our stock price will increase in line with the EPS increase because our P/E will stay the same.”

Sky Systems’ managers are not interested in the offer by Modern Auto. The managers, instead, approach HiFly, Inc., which is in the same industry as Sky Systems, to see if it would be interested in acquiring Sky Systems. HiFly is interested, and both companies believe there will be synergies from this acquisition. If HiFly were to acquire Sky Systems, it would do so by paying \($400\) million in cash.

HiFly is somewhat concerned whether antitrust regulators would consider the acquisition of Sky Systems an antitrust violation. The market in which the two companies operate consists of eight competitors. The largest company has a 25 percent market share. HiFly has the second-largest market share of 20 percent. Five companies, including Sky Systems, each have a market share of 10 percent. The smallest company has a 5 percent market share.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan