Which of the following would be Yips most appropriate response to Robinsons third observation? A. The market

Question:

Which of the following would be Yip’s most appropriate response to Robinson’s third observation?

A. The market value added is not equal to the present value of EP, although the market value of equity is equal to 122,027.

B. The market value added is equal to the present value of EP, which in this case is 44,055.

C. The market value added is not equal to the present value of EP, and market value added is equal to 44,055.

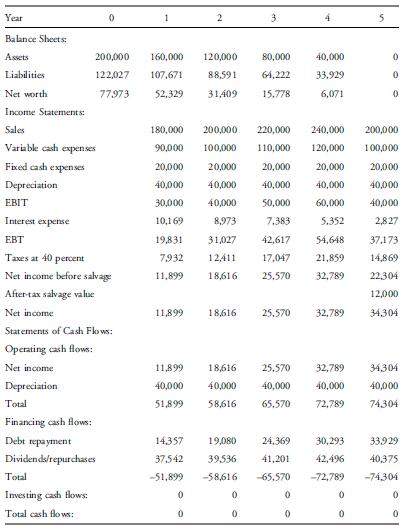

Mun Hoe Yip is valuing Pure Corporation. Pure is a simple corporation that is going out of business in five years, distributing its income to creditors and bondholders as planned in the financial statements below. Pure has a 19 percent cost of equity, 81/3 percent before-tax cost of debt, 12 percent weighted average cost of capital, and 40 percent tax rate, and it maintains a 50 percent debt/value ratio.

Yip is valuing the company using the basic capital budgeting method as well as other methods, such as EP, residual income, and claims valuation. Yip’s research assistant, Linda Robinson, makes three observations about the analysis.

Observation 1: “The present value of the company’s economic income should be equal to the present value of the cash flows in the basic capital budgeting approach.”

Observation 2: “The economic income each year is equal to the cash flow minus the economic depreciation.”

Observation 3: “The market value added is the present value of the company’s economic profit (EP), which equals the net worth of 77,973.”

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan