Bill Millers investment performance was alternating between the very top and the very bottom of his profession.

Question:

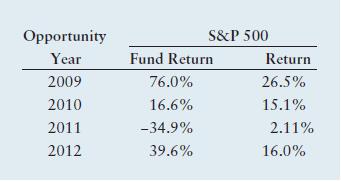

Bill Miller’s investment performance was alternating between the very top and the very bottom of his profession. What aspect of his investment strategy would lead you to expect that his performance might exhibit greater volatility than that of other mutual funds? The following table shows the annual performance from 2009 to 2012 of Miller’s Opportunity fund and the S&P 500 index.

Calculate the average annual return of the Opportunity fund and the S&P 500. Which performed better over this period? If you had invested $1,000 in each investment at the beginning of 2009, how much money would you have in each investment at the end of 2012? Calculate the standard deviation of the Opportunity fund’s return and those of the S&P 500. Which is more volatile?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter