Central Laundry is replacing an existing piece of machinery with a new model. The old machine was

Question:

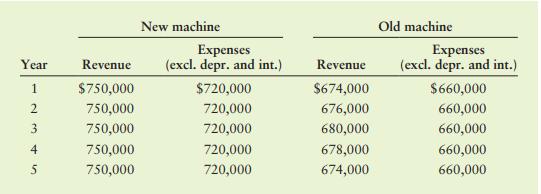

Central Laundry is replacing an existing piece of machinery with a new model. The old machine was purchased 3 years ago for $50,000 and was being depreciated under MACRS, using a 5-year recovery period. The machine has 5 years of usable life remaining. The new machine costs $76,000, requires $4,000 in installation costs, and will be depreciated under MACRS, using a 5-year recovery period. The firm can currently sell the old machine for $55,000 without incurring any removal or cleanup costs. The firm’s tax rate is 21%. The revenues and expenses (excluding depreciation and interest) for the new and old machines for the next 5 years appear in the table below.

a. Calculate the initial investment associated with replacement of the old machine by the new one.

b. Determine the operating cash flows associated with the proposed replacement.

(Note: Be sure to consider the depreciation in year 6.)

c. Depict on a timeline the net cash flows found in parts a and b associated with the proposed replacement decision.

d. How would your answers change if the new machine is eligible for 100% bonus depreciation?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart