Conad, an Italian supermarket chain, is considering two mutually exclusive projects. Each project requires an initial investment

Question:

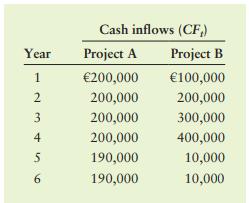

Conad, an Italian supermarket chain, is considering two mutually exclusive projects. Each project requires an initial investment (CF0) of €1,000,000. Francesco Pugliese, the general director of Conad, has set a maximum payback period of 5 years. The net receivable cash inflows associated with each project are shown in the following table.

a. Determine the payback period of each project.

b. Because the projects are mutually exclusive, Conad must choose one. Which should the company invest in?

c. Explain why the payback period might not be the best method for choosing between the projects.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: