Financial information from fiscal year 2016 for two companies competing in the cosmetics industryThe Este Lauder Companies

Question:

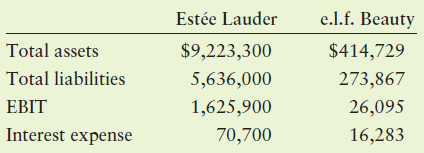

Financial information from fiscal year 2016 for two companies competing in the cosmetics industry—The Estée Lauder Companies and e.l.f. Beauty Inc.—appears in the table below. All dollar values are in thousands.

a. Calculate the debt ratio and the times interest earned ratio for each company. In what way are these companies similar in terms of their debt usage, and in what way are they very different?

b. Calculate the ratio of interest expense to total liabilities for each company. Conceptually, what do you think this ratio is trying to measure? Why are the values of this ratio dramatically different for these two firms? Suggest some reasons.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: