MACRS depreciation expense and accounting cash flow Pavlovich Instruments,Inc., a maker of precision telescopes, expects to report

Question:

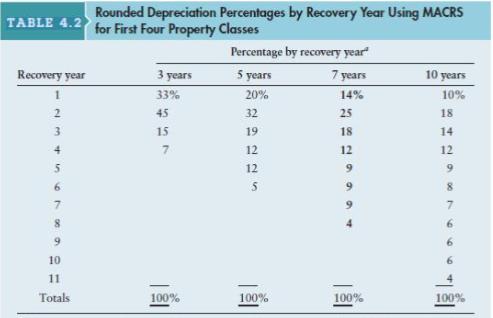

MACRS depreciation expense and accounting cash flow Pavlovich Instruments,Inc., a maker of precision telescopes, expects to report pretax income of $430,000 this year. The company’s financial manager is considering the timing of a purchase of new computerized lens grinders. The grinders will have an installed cost of $80,000 and a cost recovery period of 5 years. They will be depreciated using the MACRS schedule.

a. If the firm purchases the grinders before year-end, what depreciation expense will it be able to claim this year? Use Table 4.2

b. If the firm reduces its reported income by the amount of the depreciation expense calculated in part a, what tax savings will result?

Table 4.2

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter