Multiple IRRs Consider investment projects L through O and answer the following questions. a. What is the

Question:

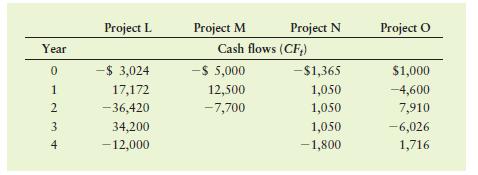

Multiple IRRs Consider investment projects L through O and answer the following questions.

a. What is the maximum number of IRRs for each project? Why?

b. Draw an NPV profile for Project L by considering the following discount rates: 0%, 13%, 25%, 29%, 33.2%, 39%, 43%, 53%, 66.7%, 87%.

c. Calculate the MIRR to three decimal places for Project L and advise whether the project is acceptable at a cost of capital of 11%.

d. Draw an NPV profile for Project M by considering the following discount rates: 0%, 10%, 20%, 30%, 40%, 50%.

e. Calculate the MIRR to three decimal places for Project M and advise whether the project is acceptable at a cost of capital of 11%.

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart

Question Posted: