Omni Motors is considering buying new equipment with an initial investment value of $30,000. The equipment has

Question:

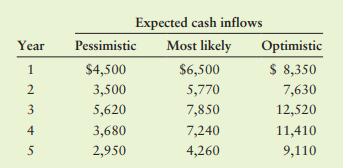

Omni Motors is considering buying new equipment with an initial investment value of $30,000. The equipment has a 5-year life and no residual value at the end of the 5 years. There are many uncertainties in the industry and, therefore, the company has estimated expected cash inflows for three different scenarios: pessimistic, most likely, and optimistic. The following table lists the company’s cost of capital is 10.5%, and the expected cash inflows. Calculate the NPV for each given scenario. Should Omni make this investment?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: