The following is some additional information regarding the Seafield Resources mining opportunity mentioned in the chapter opener.

Question:

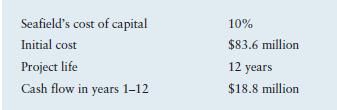

The following is some additional information regarding the Seafield Resources’ mining opportunity mentioned in the chapter opener.

a. The chapter opener reported that the project had an NPV of $66 million and an internal rate of return of 20%. From those two facts alone, what can you conclude about Seafield’s cost of capital?

b. Given the information above about the project’s initial cost and subsequent cash flows as well as the information from part a, can you estimate Seagate’s cost of capital?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: