Casa Royale Inc., a public company, retains Ying and Company CPA to audit its financial statements and

Question:

Casa Royale Inc., a public company, retains Ying and Company CPA to audit its financial statements and internal control. Howard Smythe, the partner in charge of the audit, drafted the following unqualified report:

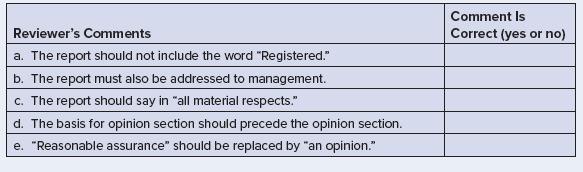

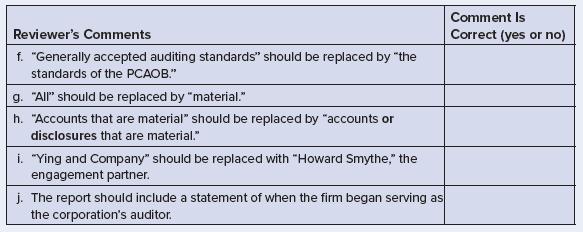

Report of Independent Registered Public Accounting Firm (Comment a)

To the shareholders and the board of directors (Comment b) of Casa Royale, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Casa Royale, Inc. (the “Company”), as of December 31, 20X7 and 20X6, the related statements of income, comprehensive income, stockholders’ equity, and cash flows, for each of the three years in the period ended December 31, 20X7, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all respects (Comment c), the financial position of the Company as of December 31, 20X7 and 20X6, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 20X7, in conformity with accounting principles generally accepted in the United States of America

We also have audited, in accordance with standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) the Company’s internal control over financial reporting as of December 31, 20X7, based on Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and our report dated February 12, 20X8, expressed an unqualified opinion.

Basis for Opinion (Comment d ) These financial statements are the responsibility of the Company’s management. Our responsibility is to express reasonable assurance (Comment e) on the Company’s financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with generally accepted auditing standards (Comment f).

Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of all (Comment g) misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts that are material (Comment h) to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Respond as to the accuracy of the following comments made by a reviewer of the report:

Step by Step Answer:

Principles Of Auditing And Other Assurance Services

ISBN: 9781260598087

22nd Edition

Authors: Ray Whittington, Kurt Pany