J. Barnes, CPA, has been retained to audit a manufacturing company with a balance sheet that includes

Question:

J. Barnes, CPA, has been retained to audit a manufacturing company with a balance sheet that includes the caption Property, Plant, and Equipment. Barnes has been asked by the company's management if audit adjustments or reclassifications are required for the following material items that have been included or excluded from Property, Plant, and Equipment.

1. A tract of land was acquired during the year. The land is the future site of the client's new headquarters, which will be constructed in the following year. Commissions were paid to the real estate agent used to acquire the land, and expenditures were made to relocate the previous owner's equipment. These commissions and expenditures were expensed and are excluded from Property, Plant, and Equipment.

2. Clearing costs were incurred to make the land ready for construction. These costs were included in Property, Plant, and Equipment.

3. During the land-clearing process, timber and gravel were recovered and sold. The proceeds from the sale were recorded as other income and are excluded from Property, Plant, and Equipment.

4. A group of machines was purchased under a royalty agreement, which provides royalty payments based on units of production from the machines. The cost of the machines, freight costs, unloading charges, and royalty payments were capitalized and are included in Property, Plant, and Equipment.

Required:

a. Describe the general characteristics of assets, such as land, buildings, improvements, machinery, equipment, and fixtures that should normally be classified as Property, Plant, and Equipment, and identify the audit objectives (i.e., how an auditor can obtain audit satisfaction) in connection with the examination of Property, Plant, and Equipment. Do not discuss specific audit procedures.

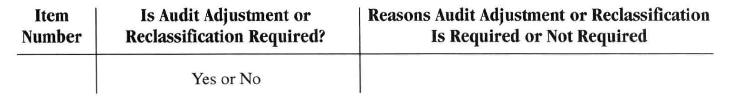

b. Indicate whether each of the above items numbered 1 to 4 requires one or more audit adjustments or reclassifications, and explain why such adjustments or reclassifications are required or not required. Organize your answer as follows:

Step by Step Answer:

Principles Of Auditing And Other Assurance Services

ISBN: 9780072327267

13th Edition

Authors: Ray Whittington, Kurt Pany