At approximately the same time that Thomas Shine was launching his business career in the retail industry

Question:

At approximately the same time that Thomas Shine was launching his business career in the retail industry in the United States, Harold Ruttenberg was doing the same in South Africa. Ruttenberg, a native of Johannesburg, paid for his college education by working nights and weekends as a sales clerk in an upscale men's clothing store. After graduation, he began importing Levi's jeans from the United States and selling them from his car, his eventual goal being to accumulate sufficient capital to open a retail store. Ruttenberg quickly accomplished that goal. In fact, by the time he was 30, he owned a small chain of men's apparel stores.Mounting political and economic troubles in his home country during the early and mid-1970s convinced Ruttenberg to move his family to the United States. South Africa's strict emigration laws forced Ruttenberg to leave practically all of his net worth behind. When he arrived in California in 1976 with his spouse and three small children, Ruttenberg had less than $30,000. Despite his limited financial resources and unfamiliarity with U.S. business practices, the strong-willed South African was committed to once again establishing himself as a successful entrepreneur in the retailing industry.Ruttenberg soon realized that the exorbitant rents for commercial retail properties in the major metropolitan areas of California were far beyond his reach. So, he moved his family once more, this time to the more affordable business environment of Birmingham, Alabama. Ruttenberg leased a vacant storefront in a Birmingham mall and a few months later opened Hang Ten Sports World, a retail store that marketed children's sportswear products. Thanks largely to his work ethic and intense desire to succeed, Ruttenberg's business prospered over the next decade.In 1988, Ruttenberg decided to take a gamble on a new business venture.Ruttenberg had come to believe that there was an opportunity to make large profits in the retail shoe business. At the time, the market for high-priced athletic shoes- basketball shoes, in particular-was growing dramatically and becoming an ever-larger segment of the retail shoe industry. The principal retail outlets for the shoes produced by Adidas, Nike, Reebok, and other major athletic shoe manufacturers were relatively small stores located in thousands of suburban malls scattered across the country, meaning that the retail athletic shoe "subindustry" was highly fragmented. The five largest retailers in this market niche accounted for less than 10 percent of the annual sales of athletic shoes.Ruttenberg realized that the relatively small floor space of retail shoe stores in suburban malls limited a retailer's ability to display the wide and growing array of products being produced by the major shoe manufacturers. Likewise, the high cost of floor space in malls with heavy traffic served to limit the profitability of shoe retailers.To overcome these problems, Ruttenberg decided that he would build freestanding "Just for FEET" superstores located near malls. To lure consumers away from mallbased shoe stores, Ruttenberg developed a three-pronged business strategy focusing on "selection," "service," and "entertainment." Ruttenberg's business plan for his superstores involved a stores-within-a-store concept; that is, he intended to create several mini-stores within his large retail outlets, each of which would be devoted exclusively to the products of individual shoe manufacturers. He believed this store design would appeal to both consumers and vendors. Consumers who were committed to one particular brand would not have to search through store displays that included a wide assortment of branded products.Likewise, his proposed floor design would provide major vendors an opportunity to participate in marketing their products. Ruttenberg hoped that his planned floor design would spur the major vendors to compete with each other in providing socalled vendor allowances to his superstores to make their individual displays more appealing than those of competitors.Customer service was the second major element of Ruttenberg's business plan for his shoe superstores. Ruttenberg planned to staff his stores so that there would be an unusually large ratio of sales associates to customers. Sales associates would be required to complete an extensive training course in "footwear technology" so that they would be well equipped to answer any questions posed by customers. When a customer chose to try on a particular shoe product, he or she would have to ask a sales associate to retrieve that item from the "back shop." Sales associates were trained to interact with customers in such a way that they would earn their trust and thus create a stronger bond with them.Just for Feet's 1998 Form 10-K described the third feature of Harold Ruttenberg's business plan as creating an "Entertainment Shopping Experience." Rock-androll music and brightly colored displays greeted customers when they entered the super-stores. When they tired of shopping, customers could play a game of "horse" on an enclosed basketball half-court located near the store's entrance or sit back and enjoy a multiscreen video bank in the store's customer lounge. Frequent promotional events included autograph sessions with major sports celebrities such as Bart Starr, the former Green Bay Packers quarterback who was also on the company's board of directors. Ruttenberg would eventually include two other key features in the floor plans of his superstores. Although Just for Feet did not target price-conscious customers, Ruttenberg added a "Combat Zone" to each superstore where such customers could rummage through piles of discontinued shoe lines, "seconds," and other discounted items. For those customers who simply wanted a pair of shoes and did not have a strong preference for a given brand, Ruttenberg incorporated a "Great Wall" into his superstores that contained a wide array of shoes sorted not by brand but rather by function. In this large display, customers could quickly compare and contrast the key features of dozens of different types of running shoes, walking shoes, basketball shoes, and cross-trainers.

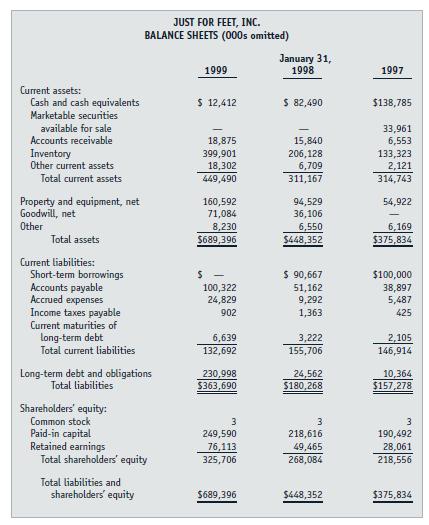

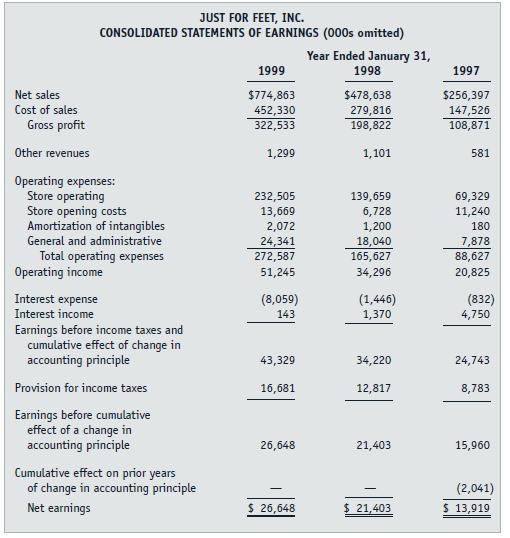

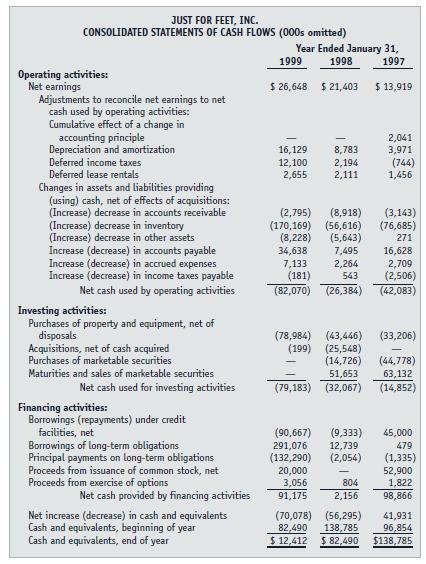

Questions1. Prepare common-sized balance sheets and income statements for Just for Feet for the period 1996-1998. Also compute key liquidity, solvency, activity, and profitability ratios for 1997 and 1998. Given these data, comment on what you believe were the high-risk financial statement items for the 1998 Just for Feet audit.2. Just for Feet operated large, high-volume retail stores. Identify internal control risks common to such businesses. How should these risks affect the audit planning decisions for such a client?3. Just for Feet operated in an extremely competitive industry, or subindustry. Identify inherent risk factors common to businesses facing such competitive conditions. How should these risks affect the audit planning decisions for such a client?4. Prepare a comprehensive list, in a bullet format, of the audit risk factors present for the 1998 Just for Feet audit. Identify the five audit risk factors that you believe were most critical to the successful completion of that audit. Rank these risk factors from least to most important and be prepared to defend your rankings. Briefly explain whether or not you believe that the Deloitte auditors responded appropriately to the five critical audit risk factors that you identified.5. Put yourself in the position of Thomas Shine in this case. How would you have responded when Don-Allen Ruttenberg asked you to send a false confirmation to Deloitte & Touche? Before responding, identify the parties who will be affected by your decision.

Step by Step Answer: