During the course of the audit of Nature Sporting Goods for the year ended December 31, 2003,

Question:

During the course of the audit of Nature Sporting Goods for the year ended December 31, 2003, the auditor discovered the following errors (documentation references are in parentheses):

1. The accounts receivable confirmation work revealed one pricing error. The book value of \($12,955.68\) should be \($11,984.00.\) The projected error based on this difference is \($14,465.\) (B-9)

2. Nature Sporting Goods had understated the accrued vacation pay by \($13,000.\) (DD-2)

3. A review of the prior year documentation indicates the following uncorrected errors:

a. Accrued vacation pay was understated by \($9,000\).

b. Sales and accounts receivable were overstated by an estimated \($60,000\) due to cutoff errors.

Required:

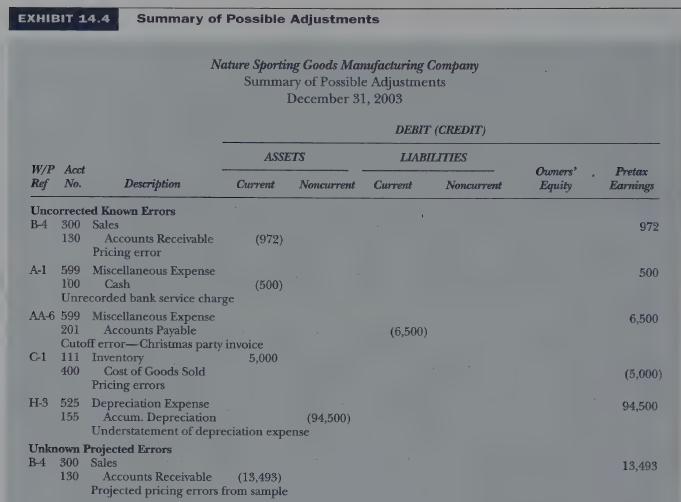

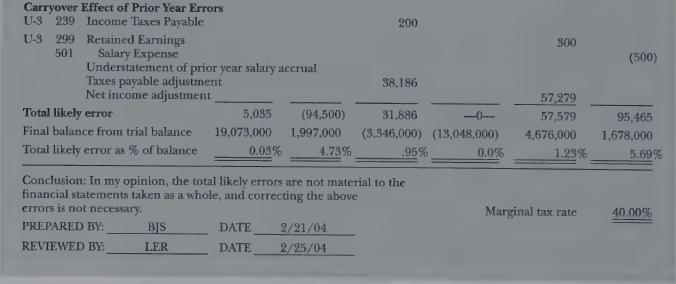

Prepare a summary of a possible adjustments schedule like the one in Exhibit 14.4, and draw your conclusion about whether the aggregate effect of these errors is material.

Nature Sporting Goods has made no adjustments to the trial balance numbers shown in Exhibit 14.4. Ignore the errors shown in the exhibit. The income tax rate is 40 percent for the current and prior year.

Step by Step Answer:

Auditing Concepts For A Changing Environment With IDEA Software

ISBN: 9780324180237

4th Edition

Authors: Larry E. Rittenberg, Bradley J. Schwieger