The audit senior has asked you to perform analytical procedures to estimate the reasonableness of recorded depreciation

Question:

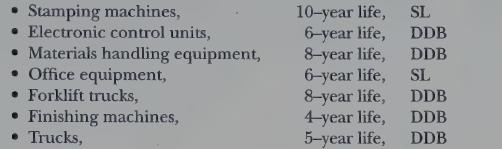

The audit senior has asked you to perform analytical procedures to estimate the reasonableness of recorded depreciation expense of a manufacturing client. The client has seven different classes of equipment, as follows (SL = straight-line depreciation, DDB = double-declining balance depreciation):

Required:

a. Describe in general terms how analytical procedures could be used to estimate the amount of depreciation expense.

b. Identify specific analytical procedures that could be used, and indicate how each would be used.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Auditing Concepts For A Changing Environment With IDEA Software

ISBN: 9780324180237

4th Edition

Authors: Larry E. Rittenberg, Bradley J. Schwieger

Question Posted: