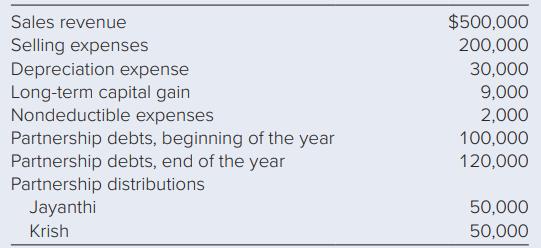

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following

Question:

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnership’s 2022 activities:

a. Calculate the partnership’s ordinary (nonseparately stated) income, and indicate which items must be separately stated.

b. Calculate Jayanthi’s allocable share of partnership items.

c. If Jayanthi has no other sources of taxable income, what is her total gross income for 2022?

d. At the beginning of the year, Jayanthi’s adjusted tax basis in her partnership interest was $25,000. Calculate her ending adjusted tax basis in her partnership interest.

Step by Step Answer:

Principles Of Taxation For Business And Investment Planning 2024

ISBN: 9781266838750

27th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick