Keiji Jones is the owner of a small retail business operated as a sole proprietorship. During 2022,

Question:

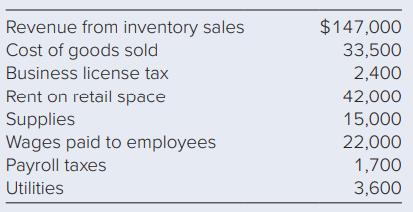

Keiji Jones is the owner of a small retail business operated as a sole proprietorship. During 2022, his business recorded the following items of income and expense:

a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in Keiji’s 2022 Form 1040.

b. Compute self-employment tax payable on the earnings of Keiji’s sole proprietorship by completing a 2022 Schedule SE, Form 1040.

c. Assume that Keiji’s business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate Keiji’s 2022 QBI deduction, before any overall taxable income limitation.

Step by Step Answer:

Principles Of Taxation For Business And Investment Planning 2024

ISBN: 9781266838750

27th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick