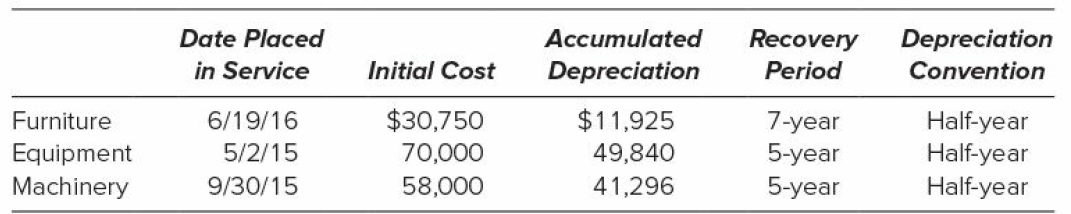

At the beginning of its 2018 tax year, Hiram owned the following business assets. On July 8,

Question:

On July 8, Hiram sold its equipment. On August 18, it purchased and placed in service new tools costing $589,000; these tools are three year recovery property. These were Hiram€™s only capital transactions for the year. Compute Hiram€™s maximum cost recovery deduction for 2018. In making your computation, assume that taxable income before depreciation exceeds $1,000,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted: