For its first four years of operation, Corporation Y reported the following taxable income. In 2019, Corporation

Question:

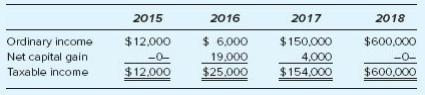

For its first four years of operation, Corporation Y reported the following taxable income.

In 2019, Corporation Y generated $900,000 ordinary income and recognized a $20,000 loss on the sale of a capital asset. It is considering selling a second capital asset before the close of 2019. This sale would generate a $21,000 capital gain that would allow the corporation to deduct its entire capital loss. Alternatively, it could carry its $20,000 net capital loss back to 2016 and 2017 and receive a tax refund. Assume the corporation’s marginal tax rate was 15 percent in 2016 and 39 percent in 2017. Which course of action do you recommend and why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2020

ISBN: 9781259969546

23rd Edition

Authors: Sally Jones, Shelley Rhoades Catanach

Question Posted: