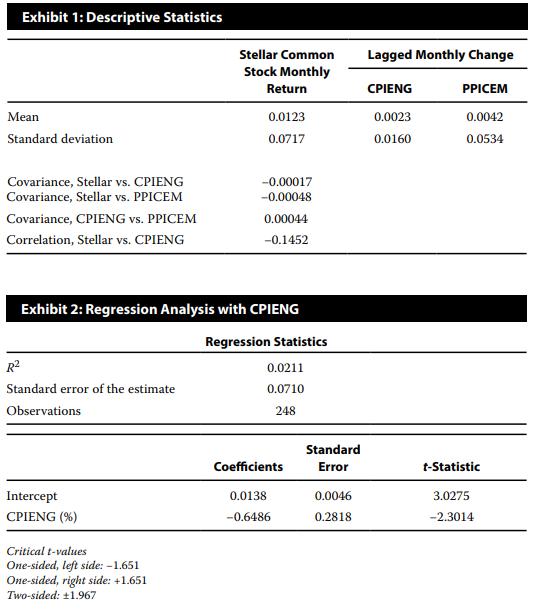

Based on the regression, if the CPIENG decreases by 1.0 percent, the expected return on Stellar common

Question:

Based on the regression, if the CPIENG decreases by 1.0 percent, the expected return on Stellar common stock during the next period is closest to:

A. 0.0073 (0.73 percent).

B. 0.0138 (1.38 percent).

C. 0.0203 (2.03 percent).

Howard Golub, CFA, is preparing to write a research report on Stellar Energy Corp. common stock. One of the world’s largest companies, Stellar is in the business of refining and marketing oil. As part of his analysis, Golub wants to evaluate the sensitivity of the stock’s returns to various economic factors. For example, a client recently asked Golub whether the price of Stellar Energy Corp. stock has tended to rise following increases in retail energy prices. Golub believes the association between the two variables is negative, but he does not know the strength of the association. Golub directs his assistant, Jill Batten, to study the relationships between (1) Stellar monthly common stock returns and the previous month’s percentage change in the US Consumer Price Index for Energy (CPIENG) and (2) Stellar monthly common stock returns and the previous month’s percentage change in the US Producer Price Index for Crude Energy Materials (PPICEM). Golub wants Batten to run both a correlation and a linear regression analysis. In response, Batten compiles the summary statistics shown in Exhibit 1 for 248 months. All the data are in decimal form, where 0.01 indicates a 1 percent return. Batten also runs a regression analysis using Stellar monthly returns as the dependent variable and the monthly change in CPIENG as the independent variable. Exhibit 2 displays the results of this regression model.

Step by Step Answer: