Answered step by step

Verified Expert Solution

Question

1 Approved Answer

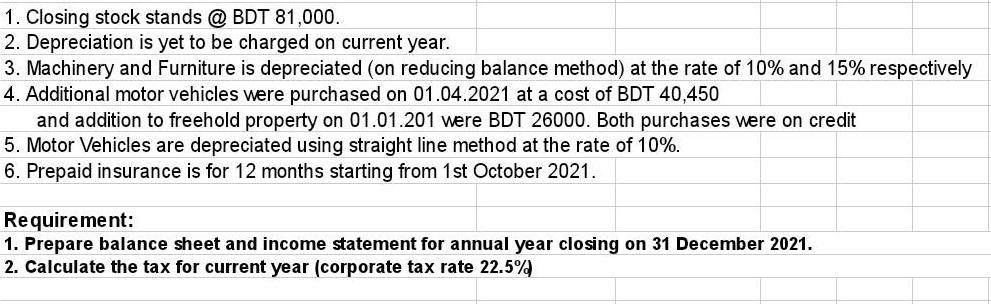

1. Closing stock stands @ BDT 81,000. 2. Depreciation is yet to be charged on current year. 3. Machinery and Furniture is depreciated (on

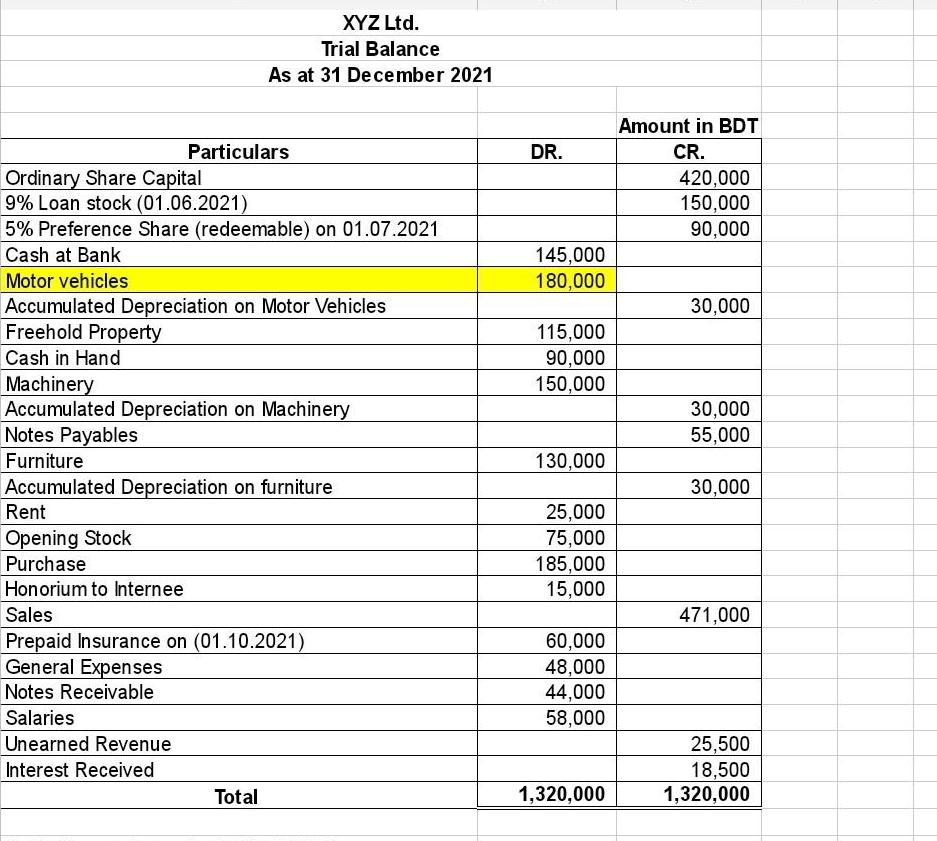

1. Closing stock stands @ BDT 81,000. 2. Depreciation is yet to be charged on current year. 3. Machinery and Furniture is depreciated (on reducing balance method) at the rate of 10% and 15% respectively 4. Additional motor vehicles were purchased on 01.04.2021 at a cost of BDT 40,450 and addition to freehold property on 01.01.201 were BDT 26000. Both purchases were on credit 5. Motor Vehicles are depreciated using straight line method at the rate of 10%. 6. Prepaid insurance is for 12 months starting from 1st October 2021. Requirement: 1. Prepare balance sheet and income statement for annual year closing on 31 December 2021. 2. Calculate the tax for current year (corporate tax rate 22.5%) XYZ Ltd. Trial Balance As at 31 December 2021 Particulars Ordinary Share Capital 9% Loan stock (01.06.2021) 5% Preference Share (redeemable) on 01.07.2021 Cash at Bank Motor vehicles Accumulated Depreciation on Motor Vehicles Freehold Property Cash in Hand Machinery Accumulated Depreciation on Machinery Notes Payables Furniture Accumulated Depreciation on furniture Rent Opening Stock Purchase Honorium to Internee Salaries Unearned Revenue Interest Received Sales Prepaid Insurance on (01.10.2021) General Expenses Notes Receivable Total DR. 145,000 180,000 115,000 90,000 150,000 130,000 25,000 75,000 185,000 15,000 60,000 48,000 44,000 58,000 1,320,000 Amount in BDT CR. 420,000 150,000 90,000 30,000 30,000 55,000 30,000 471,000 25,500 18,500 1,320,000

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started