Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Examine the hospital s statement of cash flows. What information do they provide regarding the hospital s sources and uses of cash over

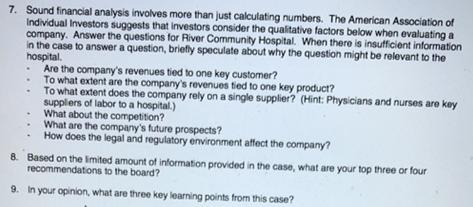

1. Examine the hospital s statement of cash flows. What information do they provide regarding the hospital s sources and uses of cash over the past two years? 2. List five or more financial strengths of the hospital? (Hint: Do not provide a list of ratios. Make a statement and then justify it with information from the financial statements and ratios.) 3. List five or more financial weaknesses of the hospital? (Hint: Do not provide a list of ratios. Make a statement and then justify it with information from the financial statements and ratios.) 4. The Board chair has asked management to develop some strategies to improve profitability and estimate the impact of the strategies on the hospital s ROE. By how much would the 2013 ROE change from each of these strategies? a. Vacant land is sold and total assets decreases by $2.0 million. Net income would not be affected and the Board wants to maintain the 2013 debt ratio. b. Debt is substituted for equity and the debt ratio increases to 48 percent. Total assets would not be affected. Interest expense would increase but better cost controls would offset the higher interest expense and thus net income would not change. c. LEAN management is implemented and total expenses decrease by $0.5 million. Total revenue, total assets, and total liabilities & net assets would not change. d. Whatever strategy Melissa chooses, she is under pressure from the Board to increase return on equity to at least 10 percent. What total margin would be needed to achieve the 10% ROE, holding everything else constant? 5. What additional financial information would be useful in the analysis? 6. Select five financial and five operating key performance indicators (KPIs) to be presented at future board meetings. 7. Sound financial analysis involves more than just calculating numbers. The American Association of Individual Investors suggests that investors consider the qualitative factors below when evaluating a company. Answer the questions for River Community Hospital. When there is insufficient information in the case to answer a question, briefly speculate about why the question might be relevant to the hospital. Are the company s revenues tied to one key customer? To what extent are the company s revenues tied to one key product? To what extent does the company rely on a single supplier? (Hint: Physicians and nurses are key suppliers of labor to a hospital.) What about the competition? What are the company s future prospects? How does the legal and regulatory environment affect the company? 8. Based on the limited amount of information provided in the case, what are your top three or four recommendations to the board? 9. In your opinion, what are three key learning points from this case?

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Q 1 River Community Hospital RCH From 2012 to 2013 RCHs net cash flow from operations increased from 3302 million to 3357 million a growth of 17 RCH spent an average of 7686 4328 2 6007 million per ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started