Question: 1. Fill-in Questions (4 points for each numbered question) 1. Although most firms have only one type of common stock, in some instances, classified stock

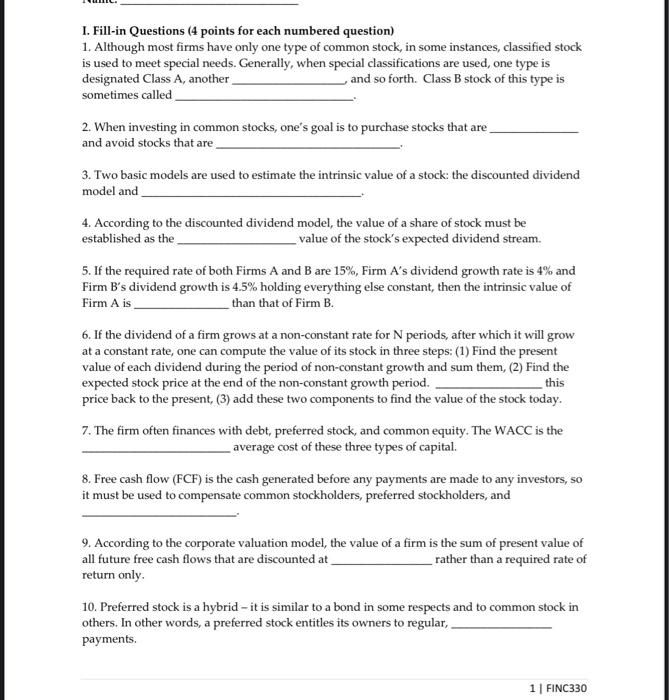

1. Fill-in Questions (4 points for each numbered question) 1. Although most firms have only one type of common stock, in some instances, classified stock is used to meet special needs. Generally, when special classifications are used, one type is designated Class A, another _, and so forth. Class B stock of this type is sometimes called 2. When investing in common stocks, one's goal is to purchase stocks that are and avoid stocks that are 3. Two basic models are used to estimate the intrinsic value of a stock: the discounted dividend model and 4. According to the discounted dividend model, the value of a share of stock must be established as the value of the stock's expected dividend stream. 5. If the required rate of both Firms A and B are 15%, Firm A's dividend growth rate is 4% and Firm B's dividend growth is 4.5% holding everything else constant, then the intrinsic value of Firm A is than that of Firm B. 6. If the dividend of a firm grows at a non-constant rate for N periods, after which it will grow at a constant rate, one can compute the value of its stock in three steps: (1) Find the present value of each dividend during the period of non-constant growth and sum them, (2) Find the expected stock price at the end of the non-constant growth period. this price back to the present, (3) add these two components to find the value of the stock today. 7. The firm often finances with debt, preferred stock, and common equity. The WACC is the average cost of these three types of capital. 8. Free cash flow (FCF) is the cash generated before any payments are made to any investors, so it must be used to compensate common stockholders, preferred stockholders, and 9. According to the corporate valuation model, the value of a firm is the sum of present value of all future free cash flows that are discounted at rather than a required rate of return only 10. Preferred stock is a hybrid - it is similar to a bond in some respects and to common stock in others. In other words, a preferred stock entitles its owners to regular, payments. 1 FINC330

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts