Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) I just deposited $10,000 in the bank. The bank tells me that it will earn a whopping 2.2% annually. How much will my

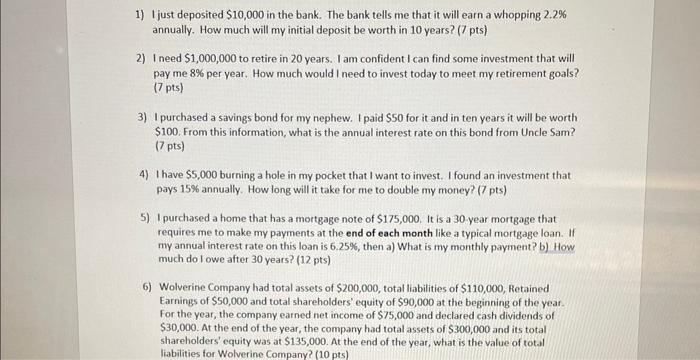

1) I just deposited $10,000 in the bank. The bank tells me that it will earn a whopping 2.2% annually. How much will my initial deposit be worth in 10 years? (7 pts) 2) I need $1,000,000 to retire in 20 years. I am confident I can find some investment that will pay me 8% per year. How much would I need to invest today to meet my retirement goals? (7 pts) 3) I purchased a savings bond for my nephew. I paid $50 for it and in ten years it will be worth $100. From this information, what is the annual interest rate on this bond from Uncle Sam? (7 pts) 4) I have $5,000 burning a hole in my pocket that I want to invest. I found an investment that pays 15% annually. How long will it take for me to double my money? (7 pts) 5) I purchased a home that has a mortgage note of $175,000. It is a 30-year mortgage that requires me to make my payments at the end of each month like a typical mortgage loan. If my annual interest rate on this loan is 6.25%, then a) What is my monthly payment? b) How much do I owe after 30 years? (12 pts) 6) Wolverine Company had total assets of $200,000, total liabilities of $110,000, Retained Earnings of $50,000 and total shareholders' equity of $90,000 at the beginning of the year. For the year, the company earned net income of $75,000 and declared cash dividends of $30,000. At the end of the year, the company had total assets of $300,000 and its total shareholders' equity was at $135,000. At the end of the year, what is the value of total liabilities for Wolverine Company? (10 pts)

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started