Answered step by step

Verified Expert Solution

Question

1 Approved Answer

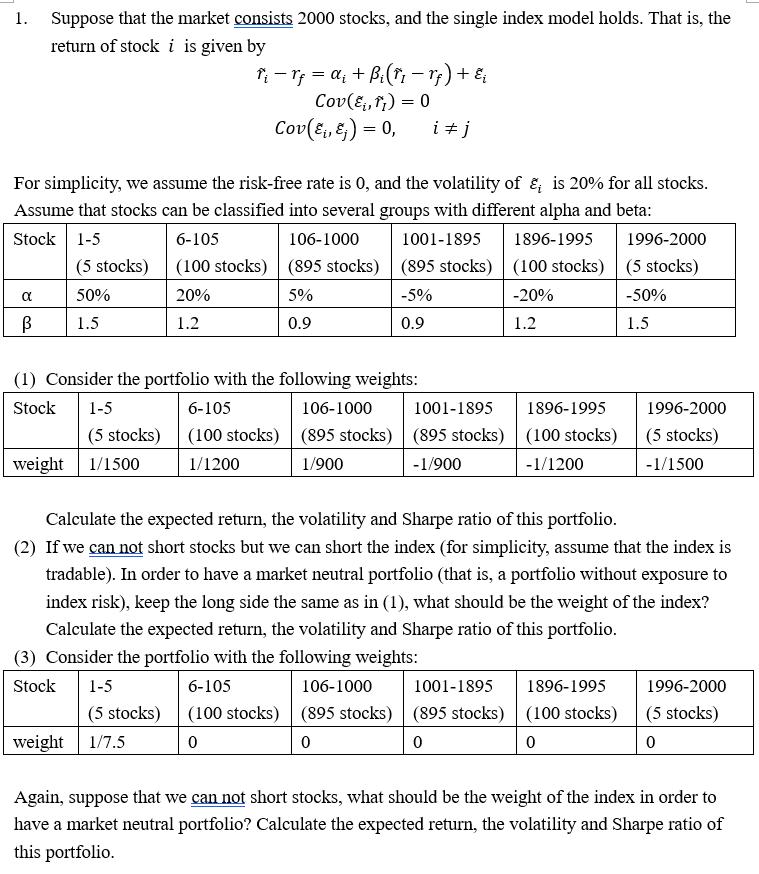

1. Suppose that the market consists 2000 stocks, and the single index model holds. That is, the return of stock i is given by

1. Suppose that the market consists 2000 stocks, and the single index model holds. That is, the return of stock i is given by - T - Yf = a + B (T Tf) + & Cov(&,) = 0 i #j For simplicity, we assume the risk-free rate is 0, and the volatility of & is 20% for all stocks. Assume that stocks can be classified into several groups with different alpha and beta: Stock 1-5 6-105 106-1000 1001-1895 1896-1995 (895 stocks) (895 stocks) (100 stocks) (100 stocks) 20% 5% -5% -20% 1.2 0.9 0.9 1.2 (5 stocks) 50% 1.5 (1) Consider the portfolio with the following weights: Stock 1-5 106-1000 (895 stocks) 1/900 (5 stocks) Cov(&, &j) = 0, weight 1/1500 Stock 1-5 (5 stocks) weight 1/7.5 6-105 (100 stocks) 1/1200 1001-1895 (895 stocks) -1/900 6-105 (100 stocks) 0 1896-1995 (100 stocks) -1/1200 Calculate the expected return, the volatility and Sharpe ratio of this portfolio. (2) If we can not short stocks but we can short the index (for simplicity, assume that the index is tradable). In order to have a market neutral portfolio (that is, a portfolio without exposure to index risk), keep the long side the same as in (1), what should be the weight of the index? Calculate the expected return, the volatility and Sharpe ratio of this portfolio. (3) Consider the portfolio with the following weights: 106-1000 (895 stocks) 0 1001-1895 (895 stocks) 0 1996-2000 (5 stocks) -50% 1.5 1896-1995 (100 stocks) 0 1996-2000 (5 stocks) -1/1500 1996-2000 (5 stocks) 0 Again, suppose that we can not short stocks, what should be the weight of the index in order to have a market neutral portfolio? Calculate the expected return, the volatility and Sharpe ratio of this portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question presents a scenario where we need to calculate expected return volatility and Sharpe ratio of different portfolios assuming a single inde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started