Question

1. What if Mr. Brinepool's cost of equity was wrong? Was there some other way to estimate the cost of equity as a check

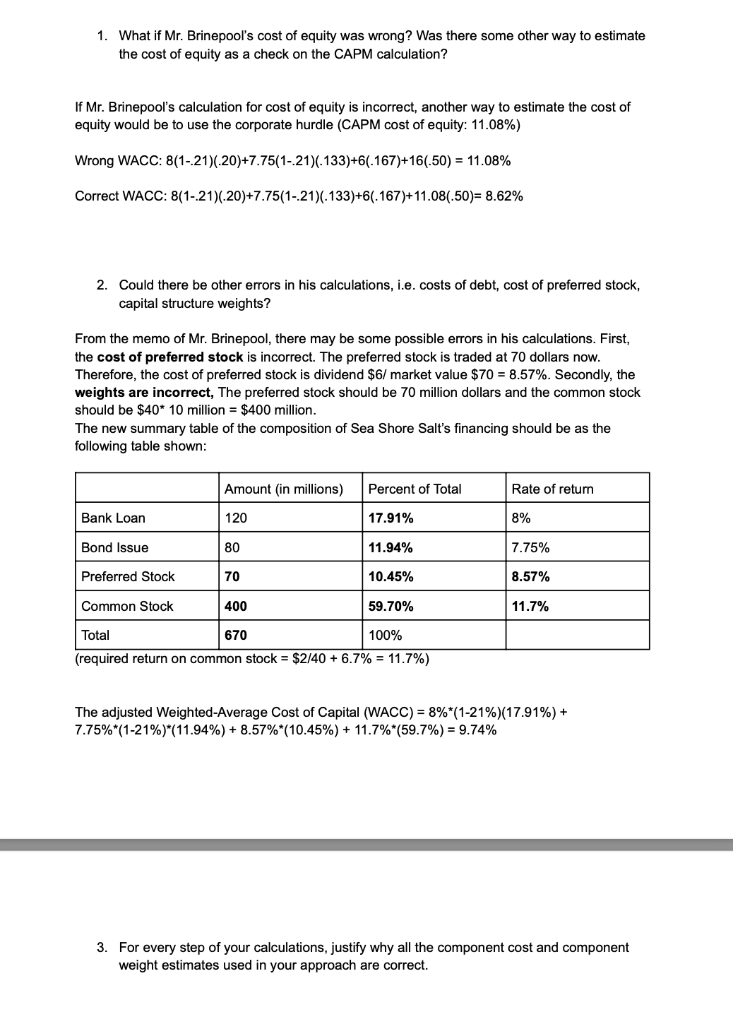

1. What if Mr. Brinepool's cost of equity was wrong? Was there some other way to estimate the cost of equity as a check on the CAPM calculation? If Mr. Brinepool's calculation for cost of equity is incorrect, another way to estimate the cost of equity would be to use the corporate hurdle (CAPM cost of equity: 11.08%) Wrong WACC: 8(1-21)(20)+7.75(1-21)(.133)+6(.167)+16(.50) = 11.08% Correct WACC: 8(1-21)(.20)+7.75(1-21)(.133)+6(.167)+11.08(.50)= 8.62% 2. Could there be other errors in his calculations, i.e. costs of debt, cost of preferred stock, capital structure weights? From the memo of Mr. Brinepool, there may be some possible errors in his calculations. First, the cost of preferred stock is incorrect. The preferred stock is traded at 70 dollars now. Therefore, the cost of preferred stock is dividend $6/ market value $70 = 8.57%. Secondly, the weights are incorrect, The preferred stock should be 70 million dollars and the common stock should be $40* 10 million = $400 million. The new summary table of the composition of Sea Shore Salt's financing should be as the following table shown: Bank Loan Bond Issue Preferred Stock Common Stock Amount (in millions) 120 80 70 Percent of Total 17.91% 11.94% 10.45% 400 59.70% Total 670 100% (required return on common stock = $2/40+ 6.7% = 11.7%) Rate of return 8% 7.75% 8.57% 11.7% The adjusted Weighted-Average Cost of Capital (WACC) = 8% *(1-21%) (17.91%) + 7.75%*(1-21%)*(11.94%) + 8.57% *( 10.45%) + 11.7% *(59.7%) = 9.74% 3. For every step of your calculations, justify why all the component cost and component weight estimates used in your approach are correct.

Step by Step Solution

3.40 Rating (122 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 What if Mr Brinepools cost of equity was wrong Was there some other way to estimate the cost of equity as a check on the CAPM calculation If ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started