Question: 1a. a. $10,200 b. $7,800 c. $9,900 d. $4,950 1b. 1c. 1d. Bonomo Corporation has provided the following information concerning a capital budgeting project: Tax

1a. a. $10,200

a. $10,200

b. $7,800

c. $9,900

d. $4,950

1b. 1c.

1c.

1d.

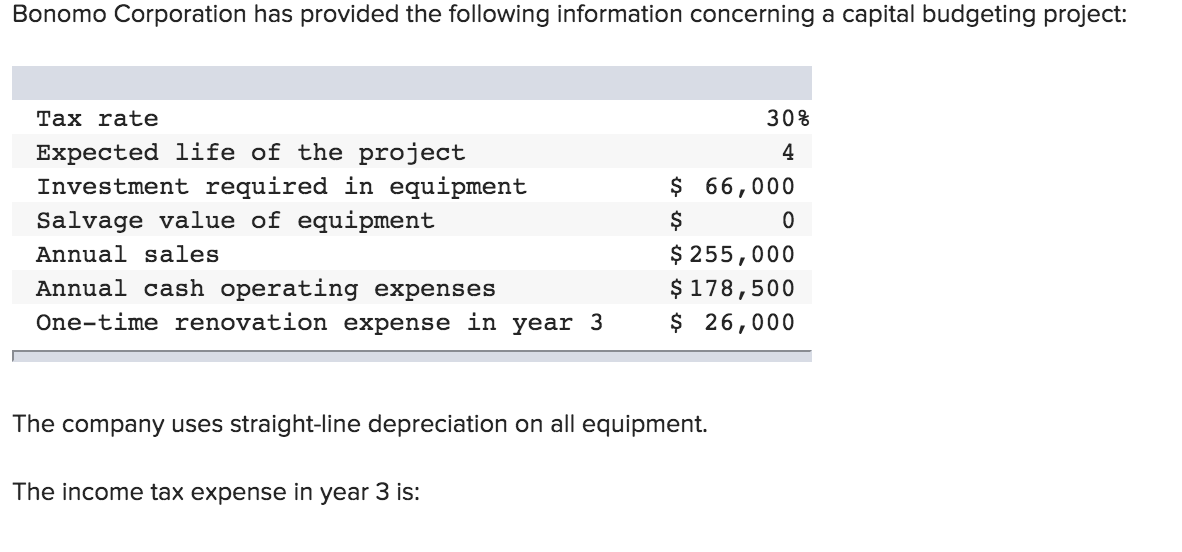

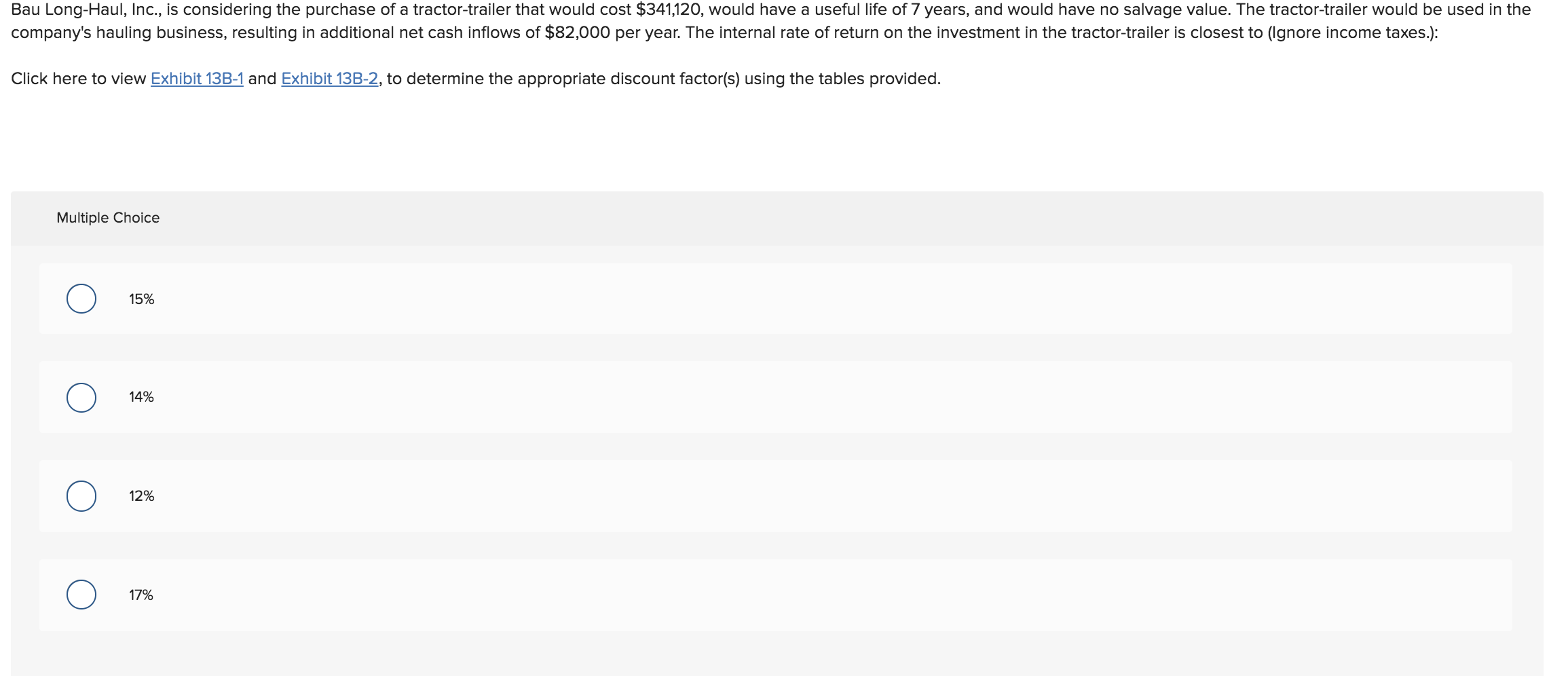

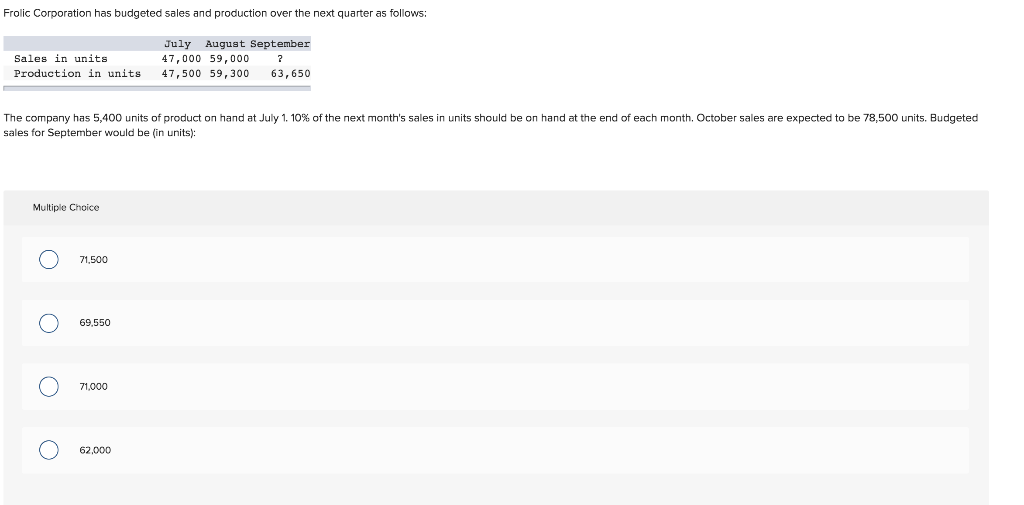

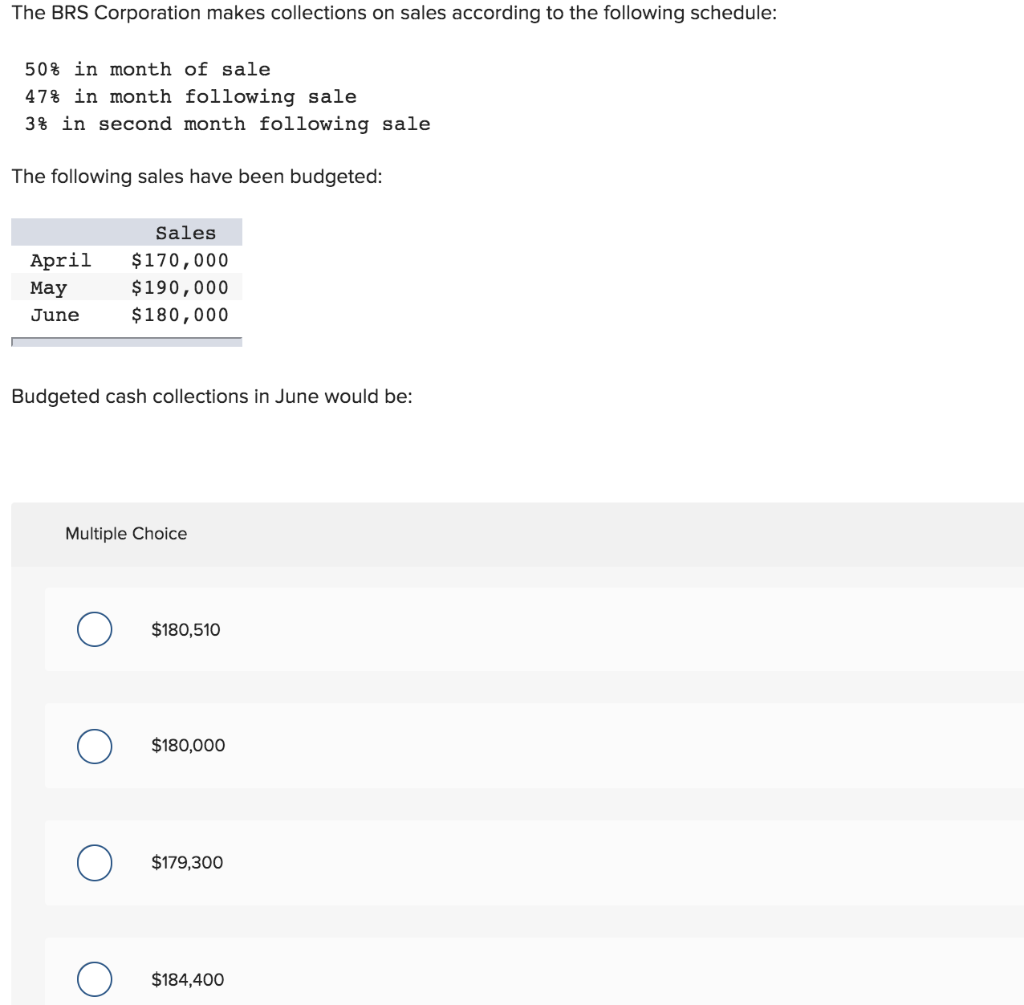

Bonomo Corporation has provided the following information concerning a capital budgeting project: Tax rate Expected life of the project Investment required in equipment Salvage value of equipment Annual sales Annual cash operating expenses One-time renovation expense in year 3 30% 4 $ 66,000 0 $ 255,000 $ 178,500 $ 26,000 The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is: Bau Long-Haul, Inc., is considering the purchase of a tractor-trailer that would cost $341,120, would have a useful life of 7 years, and would have no salvage value. The tractor-trailer would be used in the company's hauling business, resulting in additional net cash inflows of $82,000 per year. The internal rate of return on the investment in the tractor-trailer is closest to (Ignore income taxes.): Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice 0 15% 0 14% 0 12% 0 17% Frolic Corporation has budgeted sales and production over the next quarter as follows: Sales in units Production in units July August September 47,000 59,000 ? 47,500 59,300 63,650 The company has 5,400 units of product on hand at July 1. 10% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 78,500 units. Budgeted sales for September would be (in units): Multiple Choice oooo The BRS Corporation makes collections on sales according to the following schedule: 50% in month of sale 47% in month following sale 3% in second month following sale The following sales have been budgeted: April May June Sales $170,000 $190,000 $180,000 Budgeted cash collections in June would be: Multiple Choice 0 $180,510 0 $180,000 0 $179,300 0 $184,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts