Question: 1question 4 part thank you Error #1 In 20X7 Motown received cash for the issuance of common stock. When they received the cash they debited

1question 4 part thank you

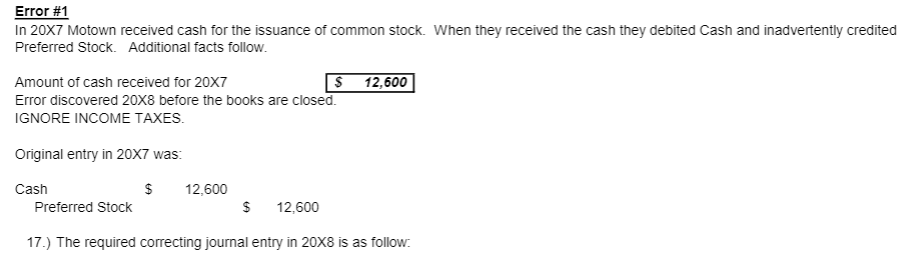

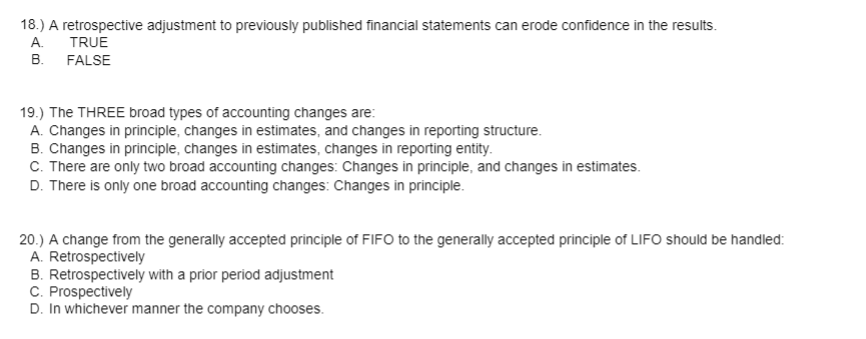

Error #1 In 20X7 Motown received cash for the issuance of common stock. When they received the cash they debited Cash and inadvertently credited Preferred Stock. Additional facts follow. Amount of cash received for 20X7 $ 12,600 Error discovered 20x8 before the books are closed. IGNORE INCOME TAXES. Original entry in 20X7 was: $ 12,600 Cash Preferred Stock $ 12,600 17.) The required correcting journal entry in 20X8 is as follow. 18.) A retrospective adjustment to previously published financial statements can erode confidence in the results. TRUE B. FALSE A 19.) The THREE broad types of accounting changes are: A. Changes in principle, changes in estimates, and changes in reporting structure. B. Changes in principle, changes in estimates, changes in reporting entity. C. There are only two broad accounting changes: Changes in principle, and changes in estimates. D. There is only one broad accounting changes: Changes in principle. 20.) A change from the generally accepted principle of FIFO to the generally accepted principle of LIFO should be handled: A. Retrospectively B. Retrospectively with a prior period adjustment C. Prospectively D. In whichever manner the company chooses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts