Question

A company manufactures to customer order and operates a job costing system. Job X3 remained incomplete at the end of Month 4 with the

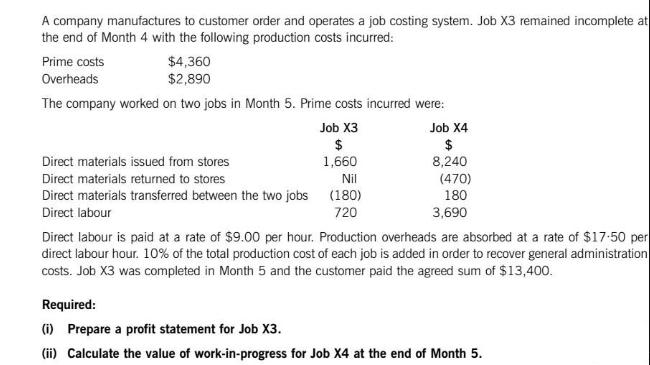

A company manufactures to customer order and operates a job costing system. Job X3 remained incomplete at the end of Month 4 with the following production costs incurred: $4,360 $2,890 The company worked on two jobs in Month 5. Prime costs incurred were: Job X3 Job X4 $ $ 1,660 8,240 Prime costs Overheads Direct materials issued from stores Direct materials returned to stores Nil Direct materials transferred between the two jobs (180) Direct labour 720 (470) 180 3,690 Direct labour is paid at a rate of $9.00 per hour. Production overheads are absorbed at a rate of $17.50 per direct labour hour. 10% of the total production cost of each job is added in order to recover general administration costs. Job X3 was completed in Month 5 and the customer paid the agreed sum of $13,400. Required: (i) Prepare a profit statement for Job X3. (ii) Calculate the value of work-in-progress for Job X4 at the end of Month 5.

Step by Step Solution

3.36 Rating (119 Votes )

There are 3 Steps involved in it

Step: 1

To prepare a profit statement for Job X3 we need to calculate the total production cost incurred in Month 5 and then deduct the customer payment to fi...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started