Answered step by step

Verified Expert Solution

Question

1 Approved Answer

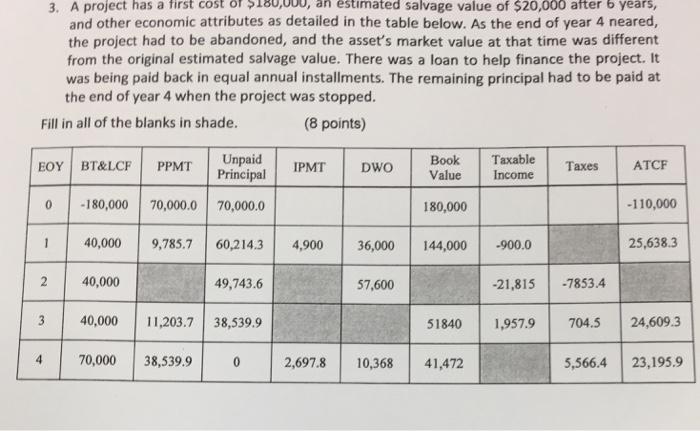

3. A project has a first cost 180,000 an estimated salvage value of $20,000 after 6 years, and other economic attributes as detailed in

3. A project has a first cost 180,000 an estimated salvage value of $20,000 after 6 years, and other economic attributes as detailed in the table below. As the end of year 4 neared, the project had to be abandoned, and the asset's market value at that time was different from the original estimated salvage value. There was a loan to help finance the project. It was being paid back in equal annual installments. The remaining principal had to be paid at the end of year 4 when the project was stopped. Fill in all of the blanks in shade. (8 points) Unpaid Principal 0 -180,000 70,000.0 70,000.0 BT&LCF PPMT - 2 4 3 40,000 9,785.7 60,214.3 4,900 40,000 40,000 49,743.6 11,203.7 38,539.9 70,000 38,539.9 IPMT 0 DWO 36,000 144,000 -900.0 57,600 Book Taxable Value Income 180,000 2,697.8 10,368 51840 41,472 Taxes -21,815 -7853.4 ATCF -110,000 25,638.3 1,957.9 704.5 24,609.3 5,566.4 23,195.9

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer for PPMT of second year PPMT is nothing but the principal repayment made to find the principa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started