Question

Use the following information for problems 1-4. On January 1, 2020, Adams acquires 100% of Baker in a transaction accounted for using the acquisition

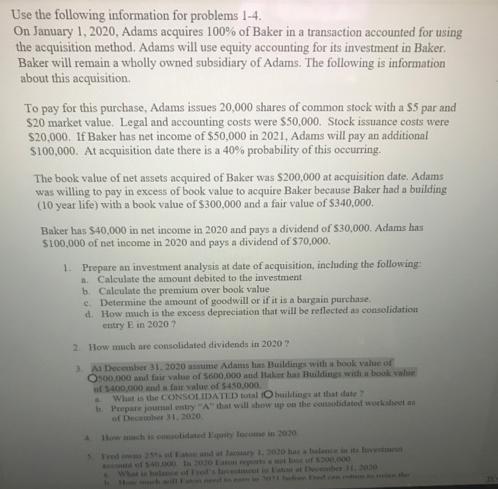

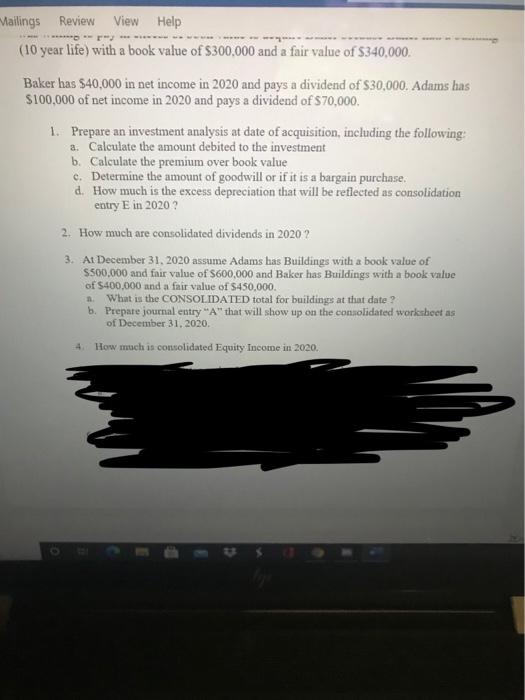

Use the following information for problems 1-4. On January 1, 2020, Adams acquires 100% of Baker in a transaction accounted for using the acquisition method. Adams will use equity accounting for its investment in Baker. Baker will remain a wholly owned subsidiary of Adams. The following is information about this acquisition. To pay for this purchase, Adams issues 20,000 shares of common stock with a $5 par and $20 market value. Legal and accounting costs were $50,000. Stock issuance costs were $20,000. If Baker has net income of $50,000 in 2021, Adams will pay an additional $100,000. At acquisition date there is a 40% probability of this occurring. The book value of net assets acquired of Baker was $200,000 at acquisition date. Adams was willing to pay in excess of book value to acquire Baker because Baker had a building (10 year life) with a book value of $300,000 and a fair value of $340,000. Baker has $40,000 in net income in 2020 and pays a dividend of $30,000. Adams has $100,000 of net income in 2020 and pays a dividend of $70,000. 1. Prepare an investment analysis at date of acquisition, including the following a. Calculate the amount debited to the investment b. Calculate the premium over book value c. Determine the amount of goodwill or if it is a bargain purchase. d. How much is the excess depreciation that will be reflected as consolidation entry E in 2020? 2. How much are consolidated dividends in 2020? 3. A1 December 31, 2020 assume Adams has Buildings with a book value of O500,000 and fair value of $600,000 and Haker has Buildings with a book valur of 1400,000 and a fair value of $450,000. What is the CONSOLIDATED total O buildings at that date 7 b. Prepare jounal entry "A" that will show up on the consolidated worksheet an of December 31, 2020. How much is consolidated Equity Tocume in 2020 5. Fred 25% of Eat and at January 1, 2020 has a balence in its luvest of $40.000 In 2030 Latou reports auf $200,000 What in hule of Frod's licet in Eat at Deber 11, 2000 Mailings Review View Help (10 year life) with a book value of $300,000 and a fair value of $340,000. Baker has $40,000 in net income in 2020 and pays a dividend of $30,000. Adams has $100,000 of net income in 2020 and pays a dividend of $70,000. 1. Prepare an investment analysis at date of acquisition, including the following: a. Calculate the amount debited to the investment b. Calculate the premium over book value c. Determine the amount of goodwill or if it is a bargain purchase. d. How much is the excess depreciation that will be reflected as consolidation entry E in 2020? 2. How much are consolidated dividends in 2020? 3. At December 31, 2020 assume Adams has Buildings with a book value of $500,000 and fair value of $600,000 and Baker has Buildings with a book value of $400,000 and a fair value of $450,000. a. What is the CONSOLIDATED total for buildings at that date? b. Prepare journal entry "A" that will show up on the consolidated worksheet as of December 31, 2020. 4. How much is consolidated Equity Income in 2020.

Step by Step Solution

3.46 Rating (130 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started