Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After a trip to Guatemala in fall 2021, Amy, who loves Latin dancing, decided to work with a few friends to create a company

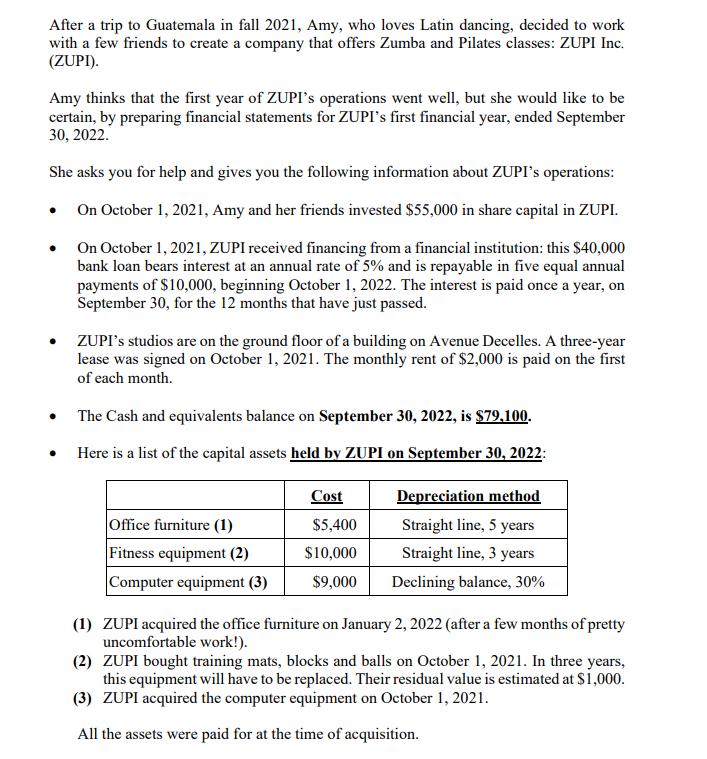

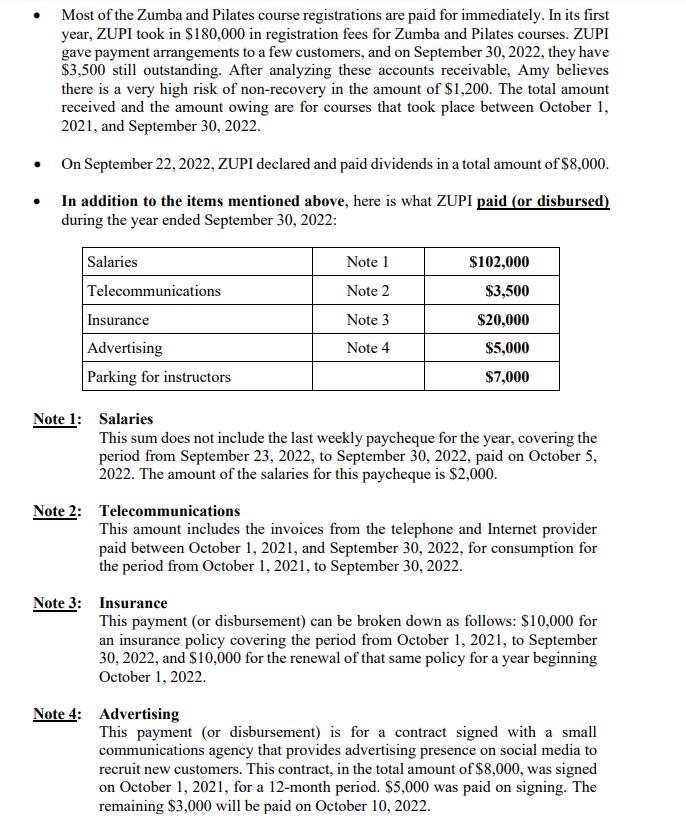

After a trip to Guatemala in fall 2021, Amy, who loves Latin dancing, decided to work with a few friends to create a company that offers Zumba and Pilates classes: ZUPI Inc. (ZUPI). Amy thinks that the first year of ZUPI's operations went well, but she would like to be certain, by preparing financial statements for ZUPI's first financial year, ended September 30, 2022. She asks you for help and gives you the following information about ZUPI's operations: On October 1, 2021, Amy and her friends invested $55,000 in share capital in ZUPI. On October 1, 2021, ZUPI received financing from a financial institution: this $40,000 bank loan bears interest at an annual rate of 5% and is repayable in five equal annual payments of $10,000, beginning October 1, 2022. The interest is paid once a year, on September 30, for the 12 months that have just passed. . ZUPI's studios are on the ground floor of a building on Avenue Decelles. A three-year lease was signed on October 1, 2021. The monthly rent of $2,000 is paid on the first of each month. The Cash and equivalents balance on September 30, 2022, is $79,100. Here is a list of the capital assets held by ZUPI on September 30, 2022: Office furniture (1) Fitness equipment (2) Computer equipment (3) Cost $5,400 $10,000 $9,000 Depreciation method Straight line, 5 years Straight line, 3 years Declining balance, 30% (1) ZUPI acquired the office furniture on January 2, 2022 (after a few months of pretty uncomfortable work!). (2) ZUPI bought training mats, blocks and balls on October 1, 2021. In three years, this equipment will have to be replaced. Their residual value is estimated at $1,000. (3) ZUPI acquired the computer equipment on October 1, 2021. All the assets were paid for at the time of acquisition. Most of the Zumba and Pilates course registrations are paid for immediately. In its first year, ZUPI took in $180,000 in registration fees for Zumba and Pilates courses. ZUPI gave payment arrangements to a few customers, and on September 30, 2022, they have $3,500 still outstanding. After analyzing these accounts receivable, Amy believes there is a very high risk of non-recovery in the amount of $1,200. The total amount received and the amount owing are for courses that took place between October 1, 2021, and September 30, 2022. On September 22, 2022, ZUPI declared and paid dividends in a total amount of $8,000. In addition to the items mentioned above, here is what ZUPI paid (or disbursed) during the year ended September 30, 2022: Salaries Telecommunications Insurance Advertising Parking for instructors Note 1: Salaries Note 2: Telecommunications This sum does not include the last weekly paycheque for the year, covering the period from September 23, 2022, to September 30, 2022, paid on October 5, 2022. The amount of the salaries for this paycheque is $2,000. Note 1 Note 2 Note 3 Note 4 Note 3: Insurance $102,000 $3,500 $20,000 $5,000 $7,000 This amount includes the invoices from the telephone and Internet provider paid between October 1, 2021, and September 30, 2022, for consumption for the period from October 1, 2021, to September 30, 2022. Note 4: Advertising This payment (or disbursement) can be broken down as follows: $10,000 for an insurance policy covering the period from October 1, 2021, to September 30, 2022, and $10,000 for the renewal of that same policy for a year beginning October 1, 2022. This payment (or disbursement) is for a contract signed with a small communications agency that provides advertising presence on social media to recruit new customers. This contract, in the total amount of $8,000, was signed on October 1, 2021, for a 12-month period. $5,000 was paid on signing. The remaining $3,000 will be paid on October 10, 2022. ZUPI is subject to a 25% tax rate that applies to its before-tax earnings. YOUR TASK: Use the information provided above to draw up ZUPI's: - Statement of Financial Position as at September 30, 2022 Statement of Earnings for the year ended September 30, 2022 Statement of Changes in Equity for the year ended September 30, 2022 Show your calculations in detail.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To create ZUPIs financial statements we must first gather all pertinent information and then proceed to compile the Statement of Financial Position the Statement of Earnings and the Statement of Chang...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started