Question

4. Question 4 (TIPS). This question is designed to illustrate the mechanics of how investors may protect themselves against inflation risk by investing in

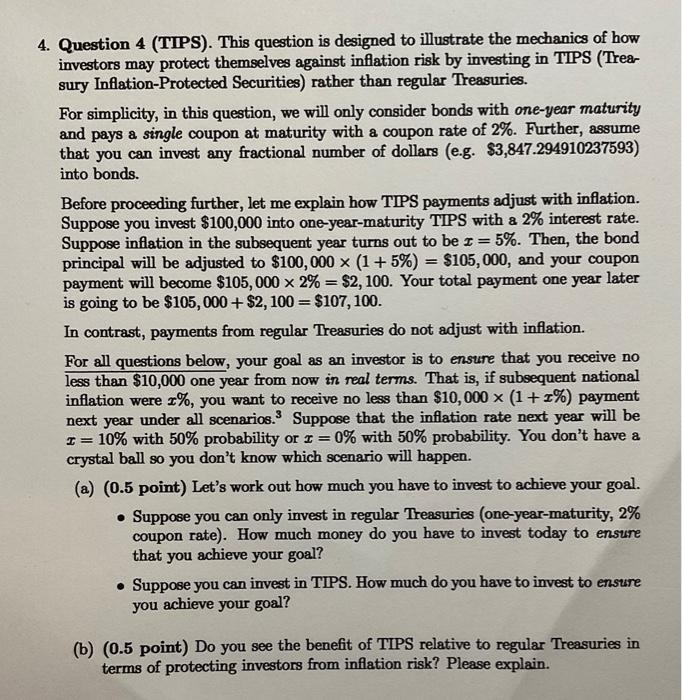

4. Question 4 (TIPS). This question is designed to illustrate the mechanics of how investors may protect themselves against inflation risk by investing in TIPS (Trea- sury Inflation-Protected Securities) rather than regular Treasuries. For simplicity, in this question, we will only consider bonds with one-year maturity and pays a single coupon at maturity with a coupon rate of 2%. Further, assume that you can invest any fractional number of dollars (e.g. $3,847.294910237593) into bonds. Before proceeding further, let me explain how TIPS payments adjust with inflation. Suppose you invest $100,000 into one-year-maturity TIPS with a 2% interest rate. Suppose inflation in the subsequent year turns out to be x = - 5%. Then, the bond principal will be adjusted to $100,000 x (1 + 5%) = $105,000, and your coupon payment will become $105,000 x 2%= $2,100. Your total payment one year later is going to be $105, 000 + $2,100 = $107, 100. In contrast, payments from regular Treasuries do not adjust with inflation. For all questions below, your goal as an investor is to ensure that you receive no less than $10,000 one year from now in real terms. That is, if subsequent national inflation were 2%, you want to receive no less than $10,000 x (1+z%) payment next year under all scenarios. Suppose that the inflation rate next year will be H= 10% with 50% probability or z = 0% with 50% robability. You don't have a crystal ball so you don't know which scenario will happen. (a) (0.5 point) Let's work out how much you have to invest to achieve your goal. Suppose you can only invest in regular Treasuries (one-year-maturity, 2% coupon rate). How much money do you have to invest today to ensure that you achieve your goal? Suppose you can invest in TIPS. How much do you have to invest to ensure you achieve your goal? (b) (0.5 point) Do you see the benefit of TIPS relative to regular Treasuries in terms of protecting investors from inflation risk? Please explain.

Step by Step Solution

3.41 Rating (135 Votes )

There are 3 Steps involved in it

Step: 1

EXPECTED INFLATION RATE0510 0505 IF INVESTED IN REGULAR TREAS...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started