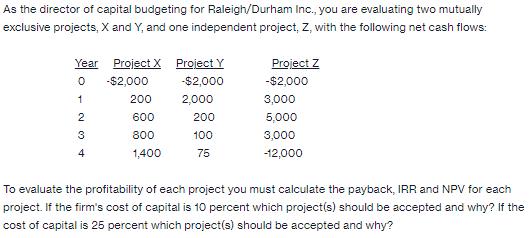

Question: As the director of capital budgeting for Raleigh/Durham Inc., you are evaluating two mutually exclusive projects, X and Y, and one independent project, Z,

As the director of capital budgeting for Raleigh/Durham Inc., you are evaluating two mutually exclusive projects, X and Y, and one independent project, Z, with the following net cash flows: Year Project X Project Y 0 -$2,000 -$2,000 1 2,000 2 3 4 200 600 800 1,400 200 100 75 Project Z -$2,000 3,000 5,000 3,000 -12,000 To evaluate the profitability of each project you must calculate the payback, IRR and NPV for each project. If the firm's cost of capital is 10 percent which project(s) should be accepted and why? If the cost of capital is 25 percent which project(s) should be accepted and why?

Step by Step Solution

There are 3 Steps involved in it

To evaluate the profitability of each project we need to calculate the payback period internal rate of return IRR and net present value NPV for each project First lets calculate the payback period for ... View full answer

Get step-by-step solutions from verified subject matter experts