Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the world reports on inflation, companies are taking steps to adjust their prices and manage their resources. Citizens are worried that prices will

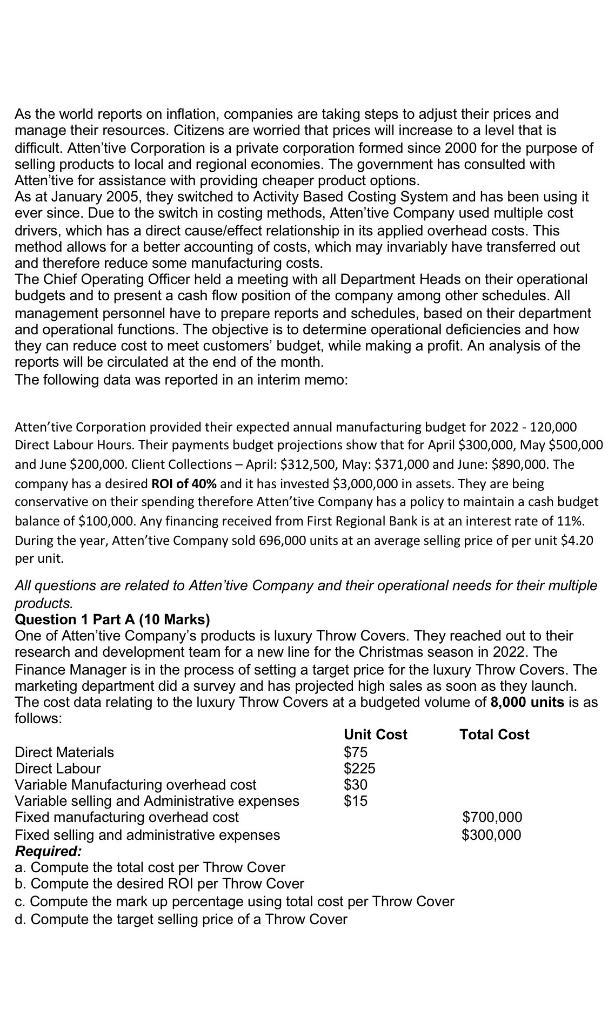

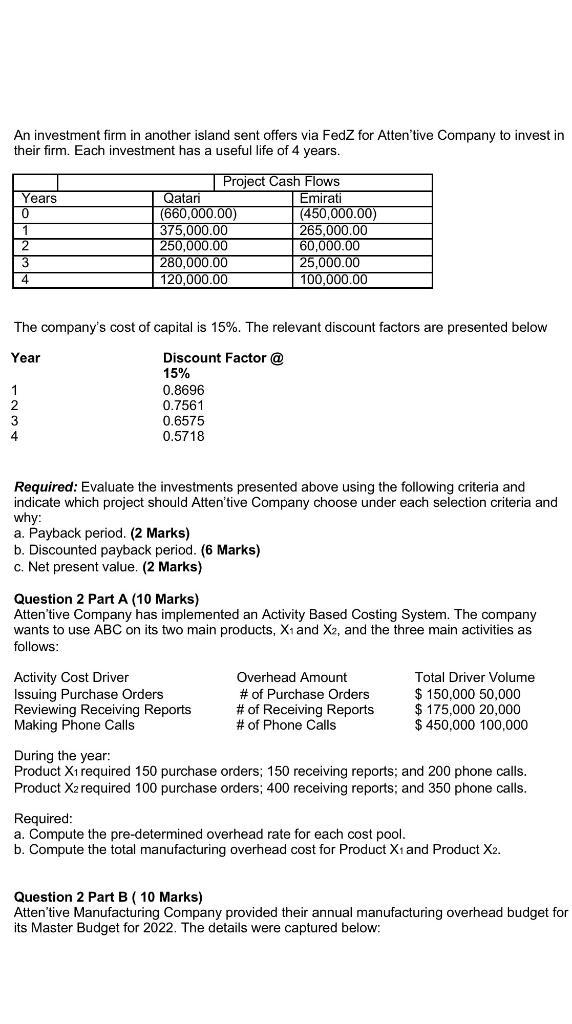

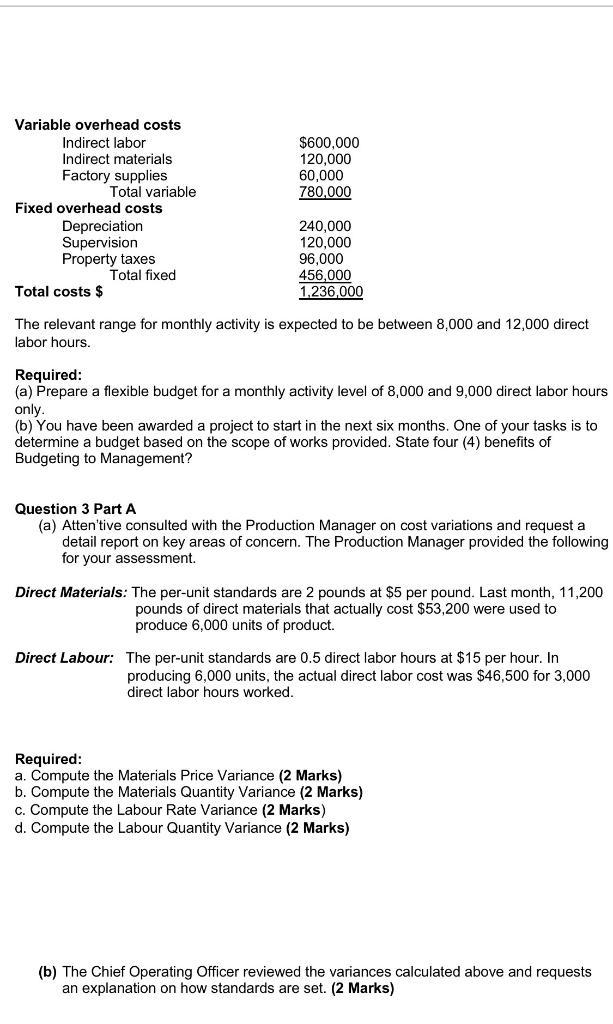

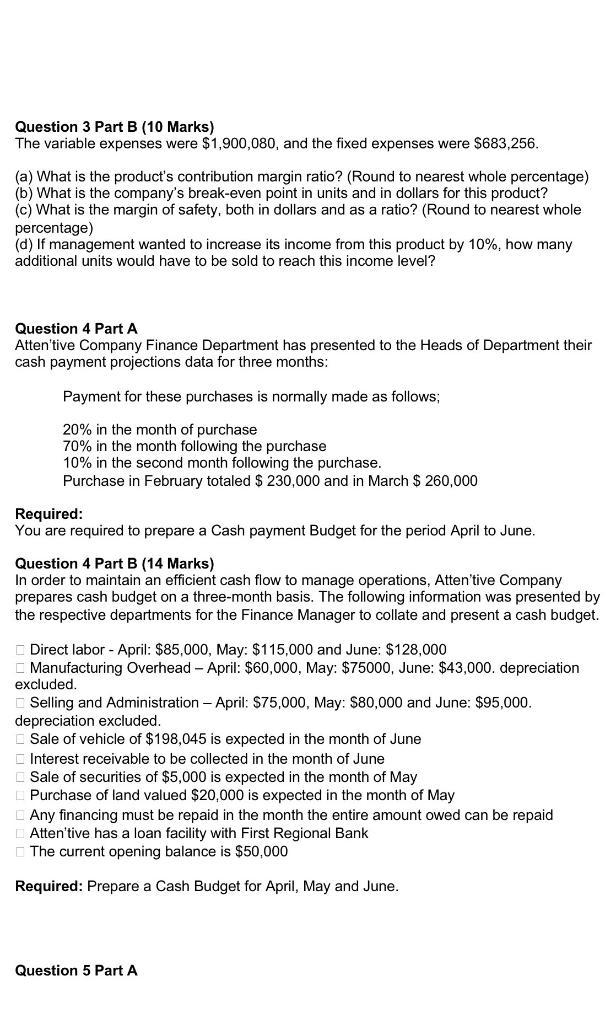

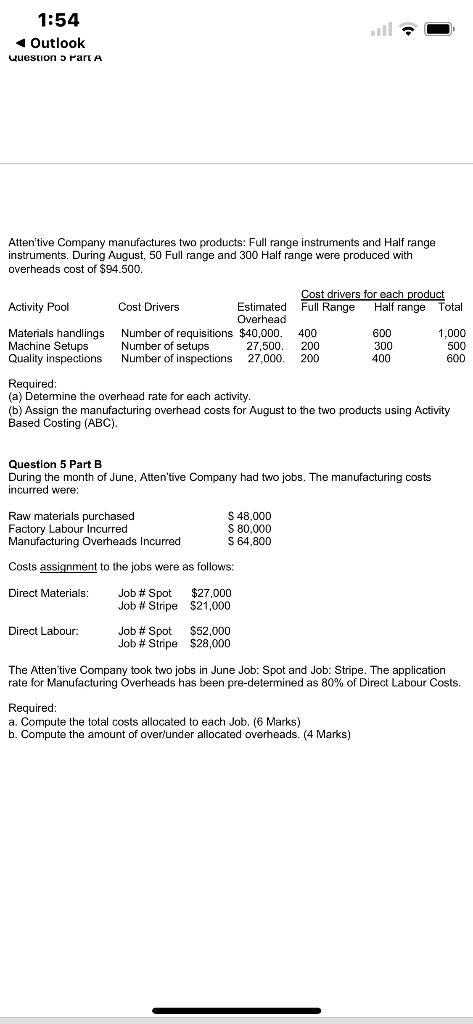

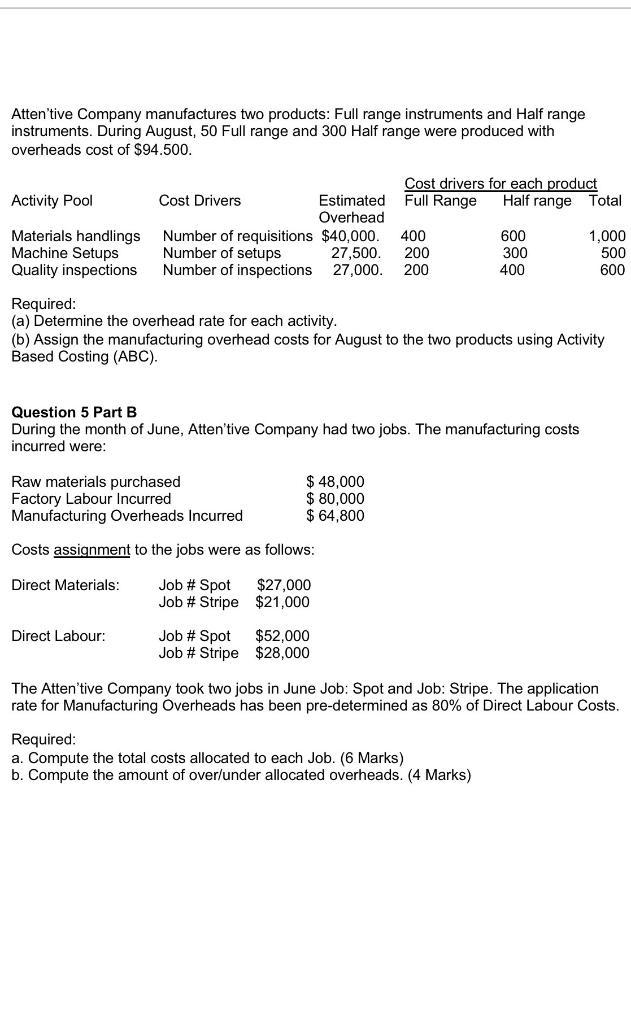

As the world reports on inflation, companies are taking steps to adjust their prices and manage their resources. Citizens are worried that prices will increase to a level that is difficult. Atten'tive Corporation is a private corporation formed since 2000 for the purpose of selling products to local and regional economies. The government has consulted with Atten'tive for assistance with providing cheaper product options. As at January 2005, they switched to Activity Based Costing System and has been using it ever since. Due to the switch in costing methods, Atten'tive Company used multiple cost drivers, which has a direct cause/effect relationship in its applied overhead costs. This method allows for a better accounting of costs, which may invariably have transferred out and therefore reduce some manufacturing costs. The Chief Operating Officer held a meeting with all Department Heads on their operational budgets and to present a cash flow position of the company among other schedules. All management personnel have to prepare reports and schedules, based on their department and operational functions. The objective is to determine operational deficiencies and how they can reduce cost to meet customers' budget, while making a profit. An analysis of the reports will be circulated at the end of the month. The following data was reported in an interim memo: Atten'tive Corporation provided their expected annual manufacturing budget for 2022 - 120,000 Direct Labour Hours. Their payments budget projections show that for April $300,000, May $500,000 and June $200,000. Client Collections - April: $312,500, May: $371,000 and June: $890,000. The company has a desired ROI of 40% and it has invested $3,000,000 in assets. They are being conservative on their spending therefore Atten'tive Company has a policy to maintain a cash budget balance of $100,000. Any financing received from First Regional Bank is at an interest rate of 11%. During the year, Atten'tive Company sold 696,000 units at an average selling price of per unit $4.20 per unit. All questions are related to Atten'tive Company and their operational needs for their multiple products. Question 1 Part A (10 Marks) One of Atten'tive Company's products is luxury Throw Covers. They reached out to their research and development team for a new line for the Christmas season in 2022. The Finance Manager is in the process of setting a target price for the luxury Throw Covers. The marketing department did a survey and has projected high sales as soon as they launch. The cost data relating to the luxury Throw Covers at a budgeted volume of 8,000 units is as follows: Total Cost Direct Materials Direct Labour Variable Manufacturing overhead cost Variable selling and Administrative expenses Fixed manufacturing overhead cost Fixed selling and administrative expenses Required: a. Compute the total cost per Throw Cover b. Compute the desired ROI per Throw Cover Unit Cost $75 $225 $30 $15 c. Compute the mark up percentage using total cost per Throw Cover d. Compute the target selling price of a Throw Cover $700,000 $300,000 An investment firm in another island sent offers via FedZ for Atten'tive Company to invest in their firm. Each investment has a useful life of 4 years. 1 Years 0 3 4 2 3 Project Cash Flows Emirati Qatari (660,000.00) 375,000.00 250,000.00 280,000.00 120,000.00 The company's cost of capital is 15%. The relevant discount factors are presented below Year Discount Factor @ 15% 0.8696 0.7561 0.6575 0.5718 (450,000.00) 265.000.00 60,000.00 25,000.00 100,000.00 Required: Evaluate the investments presented above using the following criteria and indicate which project should Atten'tive Company choose under each selection criteria and why: a. Payback period. (2 Marks) b. Discounted payback period. (6 Marks) c. Net present value. (2 Marks) Activity Cost Driver Issuing Purchase Orders Reviewing Receiving Reports Making Phone Calls Question 2 Part A (10 Marks) Atten'tive Company has implemented an Activity Based Costing System. The company wants to use ABC on its two main products, X and X2, and the three main activities as follows: Overhead Amount # of Purchase Orders # of Receiving Reports # of Phone Calls Total Driver Volume $ 150,000 50,000 $175,000 20,000 $ 450,000 100,000 During the year: Product X required 150 purchase orders; 150 receiving reports; and 200 phone calls. Product X2 required 100 purchase orders; 400 receiving reports; and 350 phone calls. Required: a. Compute the pre-determined overhead rate for each cost pool. b. Compute the total manufacturing overhead cost for Product X1 and Product X2. Question 2 Part B ( 10 Marks) Attentive Manufacturing Company provided their annual manufacturing overhead budget for its Master Budget for 2022. The details were captured below: Variable overhead costs Indirect labor Indirect materials Factory supplies Total variable Fixed overhead costs Depreciation Supervision Property taxes Total fixed $600,000 120,000 60,000 780,000 240,000 120,000 96,000 456,000 1,236,000 Total costs $ The relevant range for monthly activity is expected to be between 8,000 and 12,000 direct labor hours. Required: (a) Prepare a flexible budget for a monthly activity level of 8,000 and 9,000 direct labor hours only. (b) You have been awarded a project to start in the next six months. One of your tasks is to determine a budget based on the scope of works provided. State four (4) benefits of Budgeting to Management? Question 3 Part A (a) Atten'tive consulted with the Production Manager on cost variations and request a detail report on key areas of concern. The Production Manager provided the following for your assessment. Direct Materials: The per-unit standards are 2 pounds at $5 per pound. Last month, 11,200 pounds of direct materials that actually cost $53,200 were used to produce 6,000 units of product. Direct Labour: The per-unit standards are 0.5 direct labor hours at $15 per hour. In producing 6,000 units, the actual direct labor cost was $46,500 for 3,000 direct labor hours worked. Required: a. Compute the Materials Price Variance (2 Marks) b. Compute the Materials Quantity Variance (2 Marks) c. Compute the Labour Rate Variance (2 Marks) d. Compute the Labour Quantity Variance (2 Marks) (b) The Chief Operating Officer reviewed the variances calculated above and requests an explanation on how standards are set. (2 Marks) Question 3 Part B (10 Marks) The variable expenses were $1,900,080, and the fixed expenses were $683,256. (a) What is the product's contribution margin ratio? (Round to nearest whole percentage) (b) What is the company's break-even point in units and in dollars for this product? (c) What is the margin of safety, both in dollars and as a ratio? (Round to nearest whole percentage) (d) If management wanted to increase its income from this product by 10%, how many additional units would have to be sold to reach this income level? Question 4 Part A Atten'tive Company Finance Department has presented to the Heads of Department their cash payment projections data for three months: Payment for these purchases is normally made as follows; 20% in the month of purchase 70% in the month following the purchase 10% the month following the purchase. Purchase in February totaled $ 230,000 and in March $ 260,000 Required: You are required to prepare a Cash payment Budget for the period April to June. Question 4 Part B (14 Marks) In order to maintain an efficient cash flow to manage operations, Atten'tive Company prepares cash budget on a three-month basis. The following information was presented by the respective departments for the Finance Manager to collate and present a cash budget. Direct labor - April: $85,000, May: $115,000 and June: $128,000 Manufacturing Overhead - April: $60,000, May: $75000, June: $43,000. depreciation excluded. Selling and Administration - April: $75,000, May: $80,000 and June: $95,000. depreciation excluded. Sale of vehicle of $198,045 is expected in the month of June Interest receivable to be collected in the month of June Sale of securities of $5,000 is expected in the month of May Purchase of land valued $20,000 is expected in the month of May Any financing must be repaid in the month the entire amount owed can be repaid Atten'tive has a loan facility with First Regional Bank The current opening balance is $50,000 Required: Prepare a Cash Budget for April, May and June. Question 5 Part A 1:54 Outlook Question 5 Part A Atten'tive Company manufactures two products: Full range instruments and Half range instruments. During August, 50 Full range and 300 Half range were produced with overheads cost of $94.500. Activity Pool. Materials handlings Machine Setups Quality inspections Cost Drivers Number of requisitions Number of setups Number of inspections Raw materials purchased Factory Labour Incurred Manufacturing Overheads Incurred Costs assignment to the jobs were as follows: Direct Materials: Job # Spot $27,000 Job # Stripe $21,000 Direct Labour. Estimated Overhead $40,000. Job #Spot. Job # Stripe 400 27,500. 200 27,000. 200 $ 48,000 $ 80,000 $ 64,800 $52,000 $28,000 Cost drivers for each product Full Range Half range Total Required: (a) Determine the overhead rate for each activity. (b) Assign the manufacturing overhead costs for August to the two products using Activity Based Costing (ABC). Question 5 Part B During the month of June, Atten'tive Company had two jobs. The manufacturing costs incurred were: U 600 300 400 Required: a. Compute the total costs allocated to each Job. (6 Marks) b. Compute the amount of over/under allocated overheads. (4 Marks) 1.000 500 600 The Attentive Company took two jobs in June Job: Spot and Job: Stripe. The application rate for Manufacturing Overheads has been pre-determined as 80% of Direct Labour Costs. Atten'tive Company manufactures two products: Full range instruments and Half range instruments. During August, 50 Full range and 300 Half range were produced with overheads cost of $94.500. Activity Pool Materials handlings Machine Setups Quality inspections Cost Drivers Direct Materials: Raw materials purchased Factory Labour Incurred Manufacturing Overheads Incurred Costs assignment to the jobs were as follows: Job # Spot Job # Stripe Direct Labour: Number of requisitions $40,000. Number of setups 27,500. 200 Number of inspections 27,000. 200 Estimated Overhead Job # Spot Job # Stripe Required: (a) Determine the overhead rate for each activity. (b) Assign the manufacturing overhead costs for August to the two products using Activity Based Costing (ABC). Question 5 Part B. During the month of June, Atten'tive Company had two jobs. The manufacturing costs incurred were: $ 48,000 $ 80,000 $ 64,800 Cost drivers for each product Full Range Half range Total $27,000 $21,000 $52,000 $28,000 400 600 300 400 Required: a. Compute the total costs allocated to each Job. (6 Marks) b. Compute the amount of over/under allocated overheads. (4 Marks) 1,000 500 600 The Atten'tive Company took two jobs in June Job: Spot and Job: Stripe. The application rate for Manufacturing Overheads has been pre-determined as 80% of Direct Labour Costs.

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Part A a Compute the total cost per Throw Cover Total cost per Throw Cover Direct Materials Direct Labor Variable Manufacturing Overhead Cost Variable Selling and Administrative Expenses Fixed Manufac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started