Question: Assume a T-Bill currently sells in the market for $980.00 If firm X is expected to pay a dividend of $2.50 per share in one

Assume a T-Bill currently sells in the market for $980.00 If firm X is expected to pay a dividend of $2.50 per share in one year, and if that dividend is expected to grow at 3% annually thereafter, what should be the market price of the company's stock (rounded to two places) ?

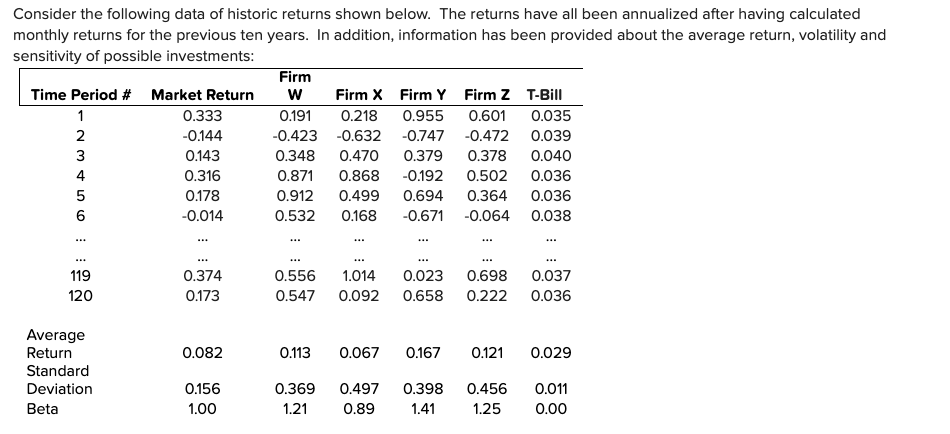

Consider the following data of historic returns shown below. The returns have all been annualized after having calculated monthly returns for the previous ten years. In addition, information has been provided about the average return, volatility and sensitivity of possible investments: Firm Time Period # Market Return W Firm X Firm Y Firm z T-Bill 0.333 0.191 0.218 0.955 0.601 0.035 2 -0.144 -0.423 -0.632 -0.747 -0.472 0.039 3 0.143 0.348 0.470 0.379 0.378 0.040 4 0.316 0.871 0.868 -0.192 0.502 0.036 5 0.178 0.912 0.499 0.694 0.364 0.036 6 -0.014 0.532 0.168 -0.671 -0.064 0.038 1 ... ... ... ... 119 120 0.374 0.173 0.556 0.547 1.014 0.092 0.023 0.658 0.698 0.222 0.037 0.036 0.082 0.113 0.067 0.167 0.121 0.029 Average Return Standard Deviation Beta 0.156 1.00 0.369 1.21 0.497 0.89 0.398 1.41 0.456 1.25 0.011 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts