Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Myron decides to purchase Caty Corporation's net assets from Caty Corporation. In exchange for selling its assets and having Myron assume its

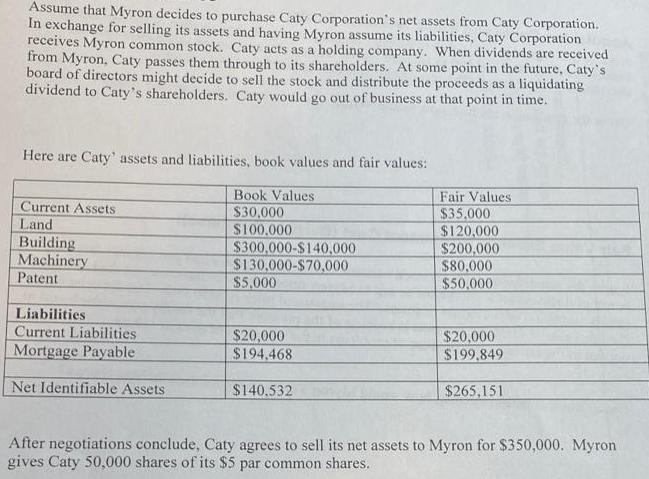

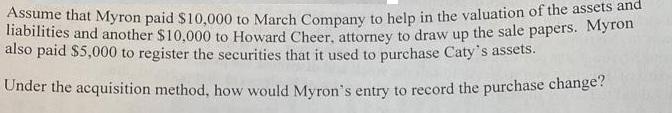

Assume that Myron decides to purchase Caty Corporation's net assets from Caty Corporation. In exchange for selling its assets and having Myron assume its liabilities, Caty Corporation receives Myron common stock. Caty acts as a holding company. When dividends are received from Myron, Caty passes them through to its shareholders. At some point in the future, Caty's board of directors might decide to sell the stock and distribute the proceeds as a liquidating dividend to Caty's shareholders. Caty would go out of business at that point in time. Here are Caty' assets and liabilities, book values and fair values: Book Values Fair Values Current Assets Land Building Machinery $30,000 $35.000 $120.000 $200,000 $80.000 $50,000 $100.000 $300,000-$140,000 $130,000-$70,000 $5,000 Patent Liabilities Current Liabilities Mortgage Payable $20,000 $194,468 $20,000 $199,849 Net Identifiable Assets $140,532 $265,151 After negotiations conclude, Caty agrees to sell its net assets to Myron for $350,000. Myron gives Caty 50,000 shares of its $5 par common shares. Assume that Myron paid $10,000 to March Company to help in the valuation of the assets ana nabilities and another $10,000 to Howard Cheer, attorney to draw up the sale papers. Myro also paid $5,000 to register the securities that it used to purchase Caty's assets. Under the acquisition method, how would Myron's entry to record the purchase change?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entry in the books of Myron Date Credit Account Titles ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started