Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Balance Sheet Assets Liabilities Current Assets Current Liabilities Cash 50 Accounts payable 42 Accounts receivable 22 Notes payable/short-term debt 7 Inventories 17 Total current assets

| Assets | Liabilities | ||

| Current Assets | Current Liabilities | ||

| Cash | 50 | Accounts payable | 42 |

| Accounts receivable | 22 | Notes payable/short-term debt | 7 |

| Inventories | 17 | ||

| Total current assets | 89 | Total current liabilities | 49 |

| Long-Term Assets | Long-Term Liabilities | ||

| Net property, plant, and equipment | 121 | Long-term debt | 128 |

| Total long-term assets | 121 | Total long-term liabilities | 128 |

| Total Liabilities | 177 | ||

| Shareholders' Equity | 33 | ||

| Total Assets | 210 | Total Liabilities and Shareholders' Equity | 210 |

Q.2. Romo, Inc. has current assets of $1850, net fixed assets of $8,600, current liabilities of $1,600, and long term debt of $6,100. What is the value of the shareholders’ equity account for this firm?

Q.4. Fyre, Inc., has sales of $625,000,costs of $260,000, depreciation expense of $79,000, interest expense of $43,000, and a tax rate of 35 percent. What is the net income for this firm?

Q.4. Fyre, Inc., has sales of $625,000,costs of $260,000, depreciation expense of $79,000, interest expense of $43,000, and a tax rate of 35 percent. What is the net income for this firm? Q.5. Suppose U.S corporation has 18 million shares outstanding at the end of 2008. If its Net earnings that year is equal to $10 million out of which it distributes dividends equivalent to $5 million, what is the earnings per share for the firm? What is dividends per share?

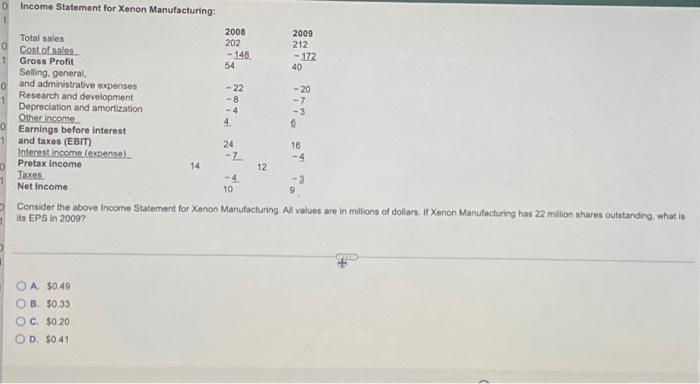

a 1 Income Statement for Xenon Manufacturing: 0 Total sales Cost of sales Gross Profit Selling, general, 0 and administrative expenses Research and development Depreciation and amortization Other income 1 Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net Income 14 A. $0.49 B. $0.33 OC. $0.20 OD. $0.41 2008 202 -148. 54 -22 -8 -4 4 24 -L 10 12 2009 212 -172 40 - 20 -7 -3 6 16 -4 -3 Consider the above Income Statement for Xenon Manufacturing All values are in millions of dollars. If Xenon Manufacturing has 22 million shares outstanding, what is its EPS in 2009?

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Net Working Capital Calculation Net Working Capital Total Current Assets Total Current Liabilitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started