Question

Barnett Industries, Inc., issued $600,000 of 8% bonds on January 1, Year 1. The bonds pay interest semiannually on July 1 and January 1.

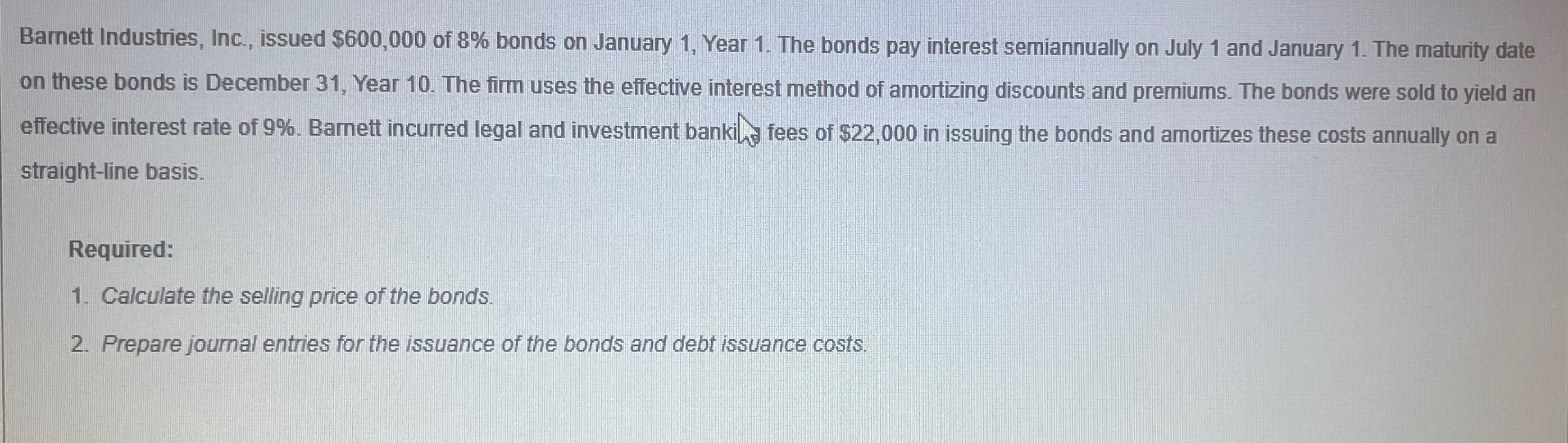

Barnett Industries, Inc., issued $600,000 of 8% bonds on January 1, Year 1. The bonds pay interest semiannually on July 1 and January 1. The maturity date on these bonds is December 31, Year 10. The firm uses the effective interest method of amortizing discounts and premiums. The bonds were sold to yield an effective interest rate of 9%. Barnett incurred legal and investment bankifees of $22,000 in issuing the bonds and amortizes these costs annually on a straight-line basis. Required: 1. Calculate the selling price of the bonds. 2. Prepare journal entries for the issuance of the bonds and debt issuance costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

1st edition

1111822360, 978-1337116619, 1337116610, 978-1111822378, 1111822379, 978-1111822361

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App