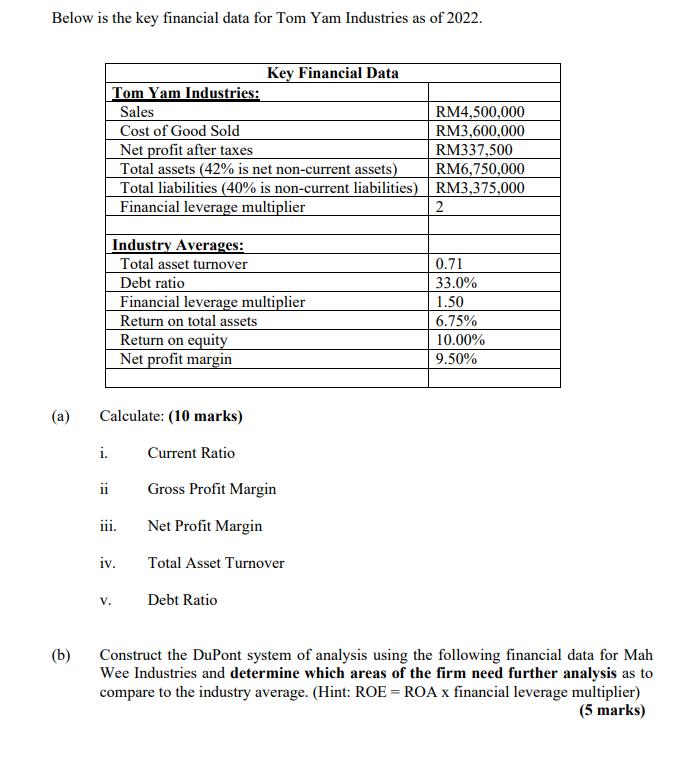

Question: Below is the key financial data for Tom Yam Industries as of 2022. (a) (b) i. ii Industry Averages: Total asset turnover Debt ratio

Below is the key financial data for Tom Yam Industries as of 2022. (a) (b) i. ii Industry Averages: Total asset turnover Debt ratio Tom Yam Industries: Sales Cost of Good Sold Net profit after taxes Total assets (42% is net non-current assets) Total liabilities (40% is non-current liabilities) Financial leverage multiplier Calculate: (10 marks) Current Ratio Gross Profit Margin Net Profit Margin Total Asset Turnover Debt Ratio 111. Key Financial Data iv. V. Financial leverage multiplier Return on total assets Return on equity Net profit margin RM4,500,000 RM3,600,000 RM337,500 RM6,750,000 RM3,375,000 2 0.71 33.0% 1.50 6.75% 10.00% 9.50% Construct the DuPont system of analysis using the following financial data for Mah Wee Industries and determine which areas of the firm need further analysis as to compare to the industry average. (Hint: ROE = ROA x financial leverage multiplier) (5 marks)

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below a i Current Ratio Total Assets Tota... View full answer

Get step-by-step solutions from verified subject matter experts