Answered step by step

Verified Expert Solution

Question

1 Approved Answer

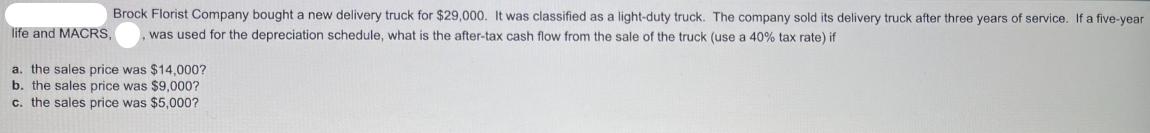

Brock Florist Company bought a new delivery truck for $29,000. It was classified as a light-duty truck. The company sold its delivery truck after

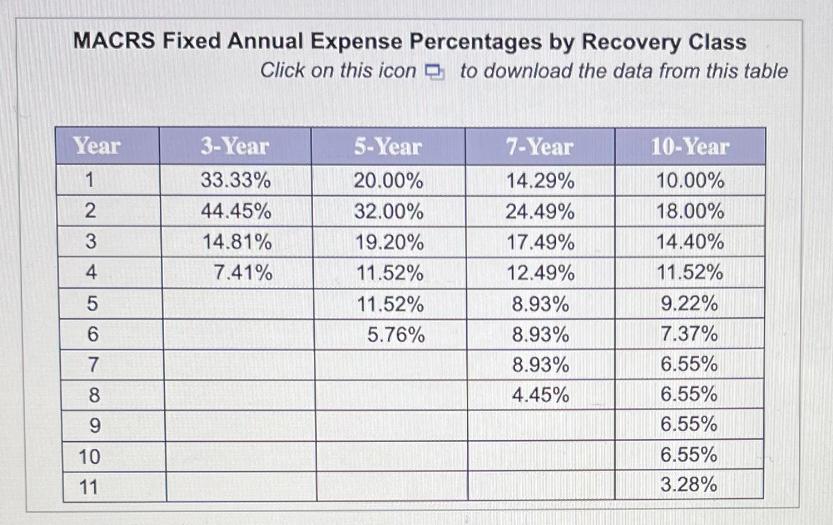

Brock Florist Company bought a new delivery truck for $29,000. It was classified as a light-duty truck. The company sold its delivery truck after three years of service. If a five-year life and MACRS, , was used for the depreciation schedule, what is the after-tax cash flow from the sale of the truck (use a 40% tax rate) if a. the sales price was $14,000? b. the sales price was $9,000? c. the sales price was $5,000? MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 4 5 6 7 8 9 10 11 3-Year 33.33% 44.45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the yearly spending percentages for each year within the designated recovery classes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started